Kantar’s Worldpanel latest Entertainment on Demand (EoD) data on the Australian video streaming market uncovered the following behaviours within the Video on Demand (VoD) market between July and September (Q3) 2024:

- Advertising-based Video on Demand (AVoD) continues to become more mainstream, with 24% of all households now watching AVoD services, boosted by the introduction of ads onto Prime Video this quarter. AVoD take-up among new subscribers rises to 30% in Q3 2024, up from 10% last year.

- The VoD market is relatively stable, growing just 0.5% quarter-on-quarter, with 7.87 million Australian households subscribing to at least one VoD service in Q3. Stan Sport (+17%), Optus Sport (+9%) and Britbox (+8%) enjoy the biggest increases in their subscriber bases.

- Disney+ and Prime Video take the highest shares of new subscriptions for Q3, followed by Britbox.

- The most popular and viewed title of the quarter went to Netflix’s rom-com Emily in Paris, followed by its mystery drama The Perfect Couple.

- Consumer satisfaction with Netflix’s VoD service portfolio rebounds this quarter, with the average Net Promoter Score (NPS) for the category back up to 19 points, a similar level to what it was a year ago.

- Growing advocacy is driven predominantly by improved satisfaction with interface-related functions, and perceived value for money – particularly with AVoD streamers who are far more likely to be happy with the value they get from their subscription.

Prime Video's ad debut: A smooth landing (so far)

After introducing ads to all Prime Video users in Australia in July, unless they upgraded to Ad Free, Amazon has so far navigated the transition with customers relatively smoothly. Churn rates have remained stable at 7% (only bettered by Netflix at 5%) and NPS has even increased slightly on the previous quarter by +3ppts to 17ppts. The successful launch of ads into Prime Video may be due to the light ad load approach, which has gently introduced customers to seeing short ads prior to watching content. This is reflected in Prime Video’s above average scores when subscribers rate the service on the number of ad breaks per show/film and length of ad breaks.

However, there are some areas that require improvement currently, such as the enjoyment of ads which is slightly below average and well behind competitors Binge and Paramount+. It remains to be seen whether Prime Video can maintain the high level of customer satisfaction with the ad-supported service, as the number of ads shown on the platform is set to ramp up next year as Amazon’s focus turns to profitability.

Prime Video also refreshed its user interface in July, making it easier for members to find content and distinguish between what is included in their subscription versus what costs extra, while providing improved content recommendations using AI. These updates have also contributed to the bump in NPS for Prime Video this quarter, with net satisfaction rising for all three areas, and ease of use in general now only trailing behind Netflix and YouTube Premium. The challenge for Amazon now will be to convert the 27% of Prime members that still do not utilise the Prime Video service to help boost their share of total VoD viewership, which lags behind Netflix and has fallen slightly year-on-year to 10%, despite overall Prime penetration growing to over a third of all Aussie households.

A mix of latest hits and classics: Netflix's winning recipe

In Q3 Netflix made the decision to stagger the release of another blockbuster series with the fourth season of Emily in Paris dropping in two parts, with a four-week break keeping fans waiting for the final five episodes. Regardless, subscribers still watched in their droves, as it topped the charts for both top content enjoyed and watched in Q3. The staggered release may have even benefited Netflix, with an improved retention rate of 95% this quarter, up +1ppt from Q2.

Netflix also enjoyed a bump in advocacy among its customer base, with NPS rising +2ppts quarter-on-quarter to 29ppts, overtaking YouTube Premium to achieve the highest score of all providers. Netflix’s high advocacy partly stems from the high satisfaction levels for the variety and quality of TV series and amount of original content on the service. Nicole Kidman’s miniseries The Perfect Couple was another Netflix original that contributed to its strong content line-up in Q3, becoming the second most enjoyed and viewed title despite only hitting screens in early September.

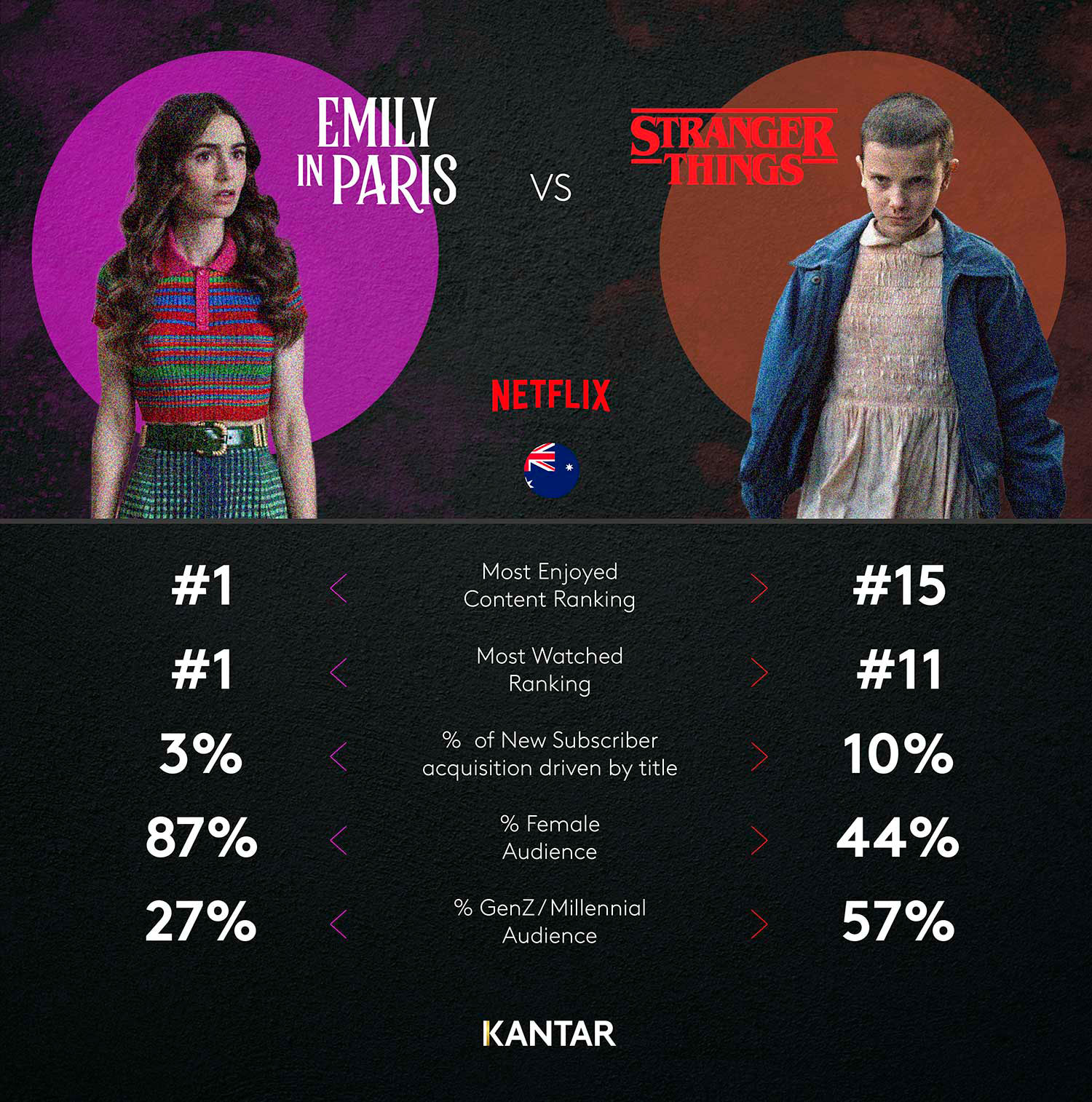

However, it's not just latest launches that attract brand new subscribers to Netflix. Stranger Things, the latest season of which aired more than two years ago, and the first more than eight years ago, drove the most new sign-ups for Netflix in Q3. Similarly, for Stan, neo-Western drama Yellowstone – which ran for five seasons from 2018-2023 – has consistently drawn in new subscribers for the past eight quarters. Overall, new sign-ups have increasingly been driven by the variety of TV series and classic films on offer, along with the depth of original content. This proves the importance of a strong back-catalogue of hit shows that can still pull in new users – both to the service and, in Netflix’s case, to the VoD category overall with 40% gateway subscribers, well above all of its key competitors.

Strong franchise back-catalogue and partnerships draw subscribers to Disney+

Disney+ leads in new sign-ups for Q3 2024, with its share almost doubling quarter-on-quarter to 11.3%, just ahead of Prime Video. Share uplift has been most apparent among millennials, school-age families and, in particular, males, drawn to the platform by Star Wars titles.

35% of new Disney+ customers signed up for specific content, by far the biggest subscription driver, led predominantly by the Star Warsand Marvel franchises, with over one in five new customers claiming to search for a particular title and finding it available on the Disney+ platform. Only Murders in the Building was the most viewed title among new Disney+ users, whilst Grey’s Anatomy was the most enjoyed. Content-related factors such as the variety of TV series and classic films, amount of original content and quality of the shows certainly drive above average net satisfaction among all Disney+ subscribers, contributing to the lower churn rate seen this quarter, down by 1.5ppts to 10.9%.

Despite the absence of a direct free trial, over one in five new Disney+ customers cited the offer of a free trial in some form as a factor that influences decisions in their research journey. Promotional partnerships have been prevalent in the latest quarter, with either a discount on a subscription with the purchase of tickets for live events, for example, drawing customers to the platform. In the case of its collaboration with Hubbl, 7% of new Disney+ subscribers opted for billing via Hubbl, with many of them undoubtedly taking advantage of three months of Disney+ Premium completely free with their Hubbl purchase.

As a result of such cost-saving mechanisms, net satisfaction with value for money among Disney+ customers has risen to 18% this quarter, although it still under-indexes compared to the market average of 22%. With attractive promotional deals continuing in the Q4 period, including four months of Disney+ Standard free with Ticketmaster, it will be interesting to see if the value perception increases further – indeed, planned cancellation of a Disney+ service in the next three months has fallen quarter-on-quarter by 1ppt to 10%.

Access the interactive data visualisation tool for additional information, and reach out to our experts.