Grocery price inflation currently stands at 5.3% compared to the same 12-week end period last year. The rise in average prices is clearly affecting both sales performance and shopper behaviour. As grocery bills rise alongside other household expenses, Irish consumers are cautious with their spending and actively seek out promotions to secure the best value.

Summer celebrations kick off early

An unusually sunny kick-off to the summer in Ireland alongside the June bank holiday was a cause for celebration for many people.Thanks to the warmer weather, we saw shoppers picking up more suncream compared to the same time last year (+6%) but also looking for ways to cool down and freshen up. Shoppers spent a combined additional €11.6 million on prepared fresh fruit, water and dilutes, smoothies and juices. Convenience was also a priority as the sun shone with an additional €2.4 million spent on chilled ready meals.

Shoppers spent €802 million on promotional lines during the latest 12-week period, a 15.7% increase compared to the previous year. Key categories saw significant growth, including table sauces, fabs and mixers, carbonates, frozen confectionery, beer and cider, all growing ahead of the total market for promotional lines.

Brands and own label both performed strongly, growing at 6.2%. Shoppers spent an additional €197m on these ranges versus last year.

Own label overtakes brands in value share of the total market at 47.3%, compared to brands with a 47.1% value share. Premium own label experienced double-digit growth (+15.3%) over the 12 weeks, outperforming the total market (+6.9%) and both brands and total own label. This growth has resulted in a 4.1% value share for premium own label compared to 3.8% last year. Retailers must continue to find a balance between delivering compelling value and navigating rising operational costs.

Retailer and channel performance

Total online holds 5.9% value share of the market and sees sales rising by 9.1% year-on-year, with shoppers spending an additional €17.5 million through this channel. Over the latest 12-week period, shoppers purchased their groceries more often online, up by 8.9%, contributing €16.9 million to its overall performance.

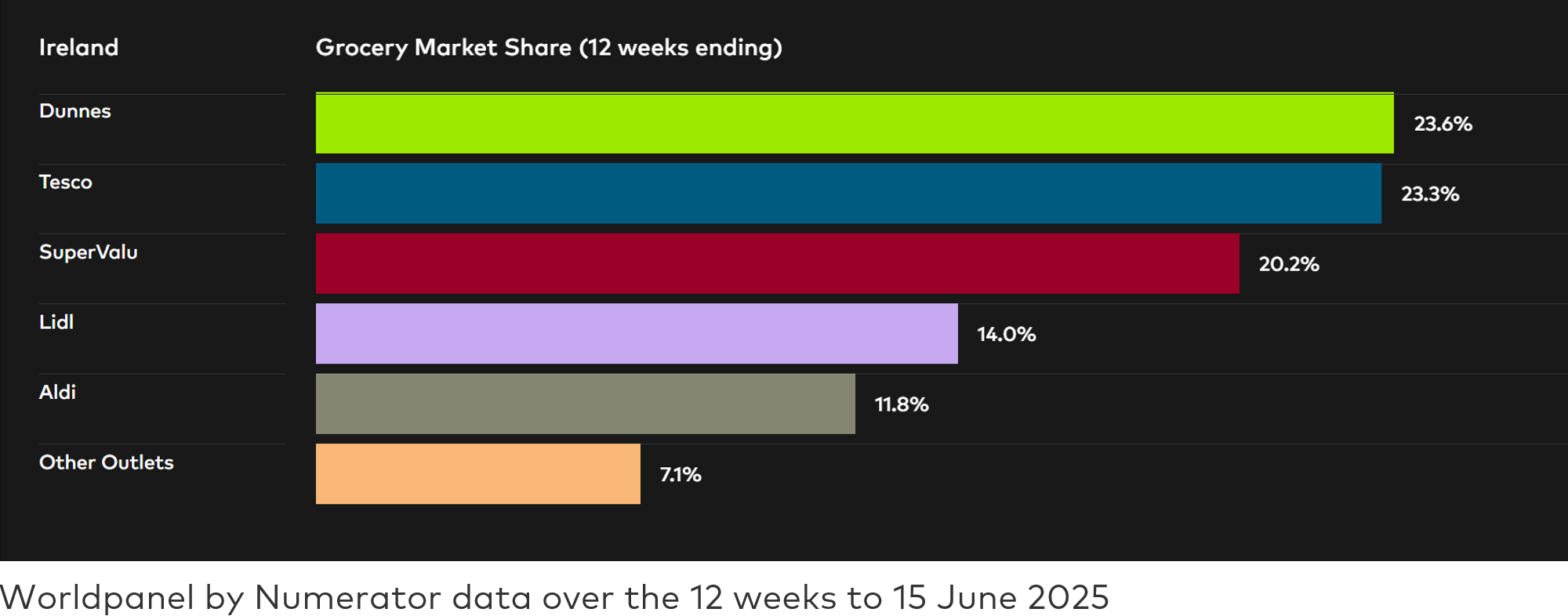

Over the latest 12 weeks, Dunnes holds 23.6% market share, with sales growth of 8% year-on-year. Dunnes shoppers returned to store more often, up 5.6% which contributed a combined €43.9 million to their overall performance.

Tesco holds 23.3% of the market, with value growth of 7.7% year-on-year. Shoppers increased their trips to store by 4.4%, which contributed €34.1 million to overall performance.

SuperValu holds 20.2% of the market with growth of 5.6%. Consumers made the most shopping trips to this grocer, averaging 25 trips over the latest 12 weeks, this is the highest shopping trips seen since July 2023. This increase in the number of shopping trips contributed an additional €51.7 million to its performance.

Lidl holds 14% market share, up 8.5%. Lidl recruited new shoppers in-store, while encouraging consumers to make larger trips, resulting in an additional €13 million in sales. Aldi holds 11.8% market share, up 6.4%. Increased store trips and new shoppers drove an additional €26.9 million in sales.