Grocery footfall hit a five-year high over the four weeks to 15 June as take-home grocery sales grew by 4.1% compared with last year, according to our latest figures. The jump in shopping frequency came despite another rise in grocery price inflation which hit 4.7% this month, its highest level since February 2024. This is up from 4.1% in May.

Higher prices didn’t stop shoppers making 490 million trips to the supermarket over the latest month, averaging almost 17 per British household. That’s the highest we’ve recorded since March 2020. As the sun tempted more people out, fresh fruit sales were one of the biggest winners. Consumers bought 2,400 packs of strawberries every minute in the last four weeks. People are trading up to more exotic fruits too, with sales of mangoes and blueberries climbing by 27% and 10% each.

However, a rise in frequency was balanced out by a drop in average trip spend, which fell back by three pence to £23.89. Consumer concerns over price are continuing, and this is reflected in the figures. Sales of own label ranges grew at 4.2% this month, ahead of branded lines, as shoppers looked to balance their budgets. Deals also remain an important tool for retailers to offer value and the proportion of spending on promotion stepped up to 28.8% this period.

Weight loss drugs usage doubles

Overall grocery volumes fell slightly by 0.4% over the last four weeks, the first year-on-year decline this year. A small part of this fall could also be down to changing health priorities such as the growing use of GLP-1 weight loss drugs. Supermarkets and grocery brands are entering new territory as weight loss drugs become more popular, with four in 100 households in Great Britain now including at least one GLP-1 user.* That’s almost twice as many as last year so while it’s still pretty low, it’s definitely a trend that the industry should keep an eye on as these drugs have the potential to steer choices at the till. Four in five of the users we surveyed say they plan to eat fewer chocolates and crisps, and nearly three quarters intend to cut back on biscuits.

Ocado, Lidl and M&S all in double digit growth

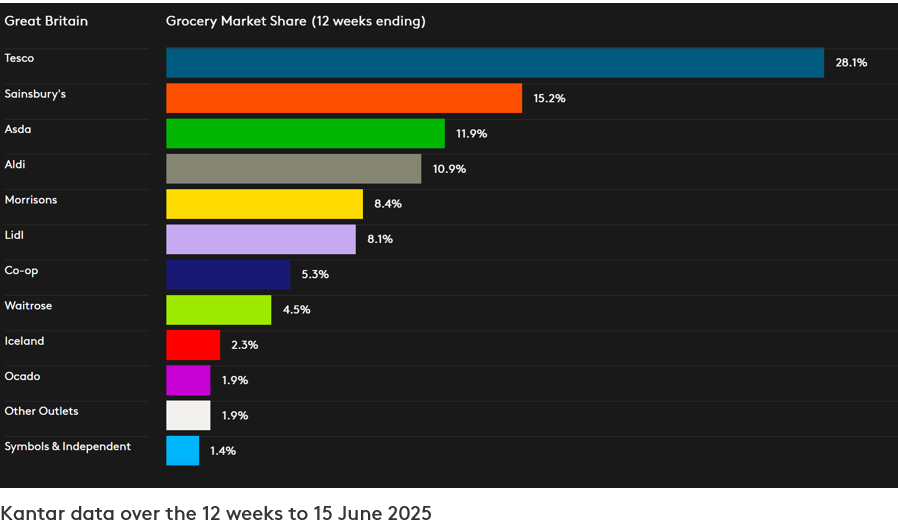

Continuing to lead the pack, Ocado was the fastest growing grocer with sales up 12.2% in the 12 weeks to 15 June 2025. Its growth continues to be driven by more frequent visits to the online store, and strong performance within its traditional heartlands of London and Southern England. Ocado’s hold of the market now sits at 1.9%.

Among bricks and mortar grocers, Lidl was the fastest growing at 11.2% – its third consecutive month of double-digit growth. Lidl’s portion of the market reached 8.1%, an increase of 0.4 percentage points on this time last year. Fellow discounter Aldi increased its share to 10.9% as sales rose by 6.5%.

Spending through the tills at Tesco accelerated to 7.0%. The grocer saw the highest share gain over the period, at 0.5 percentage points, taking it to 28.1%. Sainsbury’s’ share also nudged up in the last 12 weeks to 15.2%, as sales grew by 5.7%. Morrisons now holds 8.4% of the market, with spending rising by 2.2%.

Asda’s market share stands at 11.9% with sales through the tills 1.7% lower than a year ago, but this does represent an improving trend as the Leeds-based retailer looks to return to growth over the summer months. Waitrose boosted its sales by 5.5% – the highest since March 2021, meaning it now holds a 4.5% portion.

Convenience retailer Co-op accounts for a 5.3% share while frozen food specialist Iceland retains 2.3% with sales climbing by 1.9%. Spending on groceries at M&S** rose by 12.0% over the same period.

* Kantar PanelVoice, GLP-1 UK Survey, fielded in February 2025, interviewing 11,824 households.

**Please note: with a higher proportion of clothing and general merchandise in its sales mix, M&S does not fall under the definition of ‘grocers’ using the Till Roll methodology on which the Kantar Grocery Market Share release is based. For this reason, a comparable market share number is not provided for M&S. The M&S growth number quoted in this update is for FMCG sales only, while the figures for grocers in the Grocery Market Share table cover total spending through supermarkets’ tills.