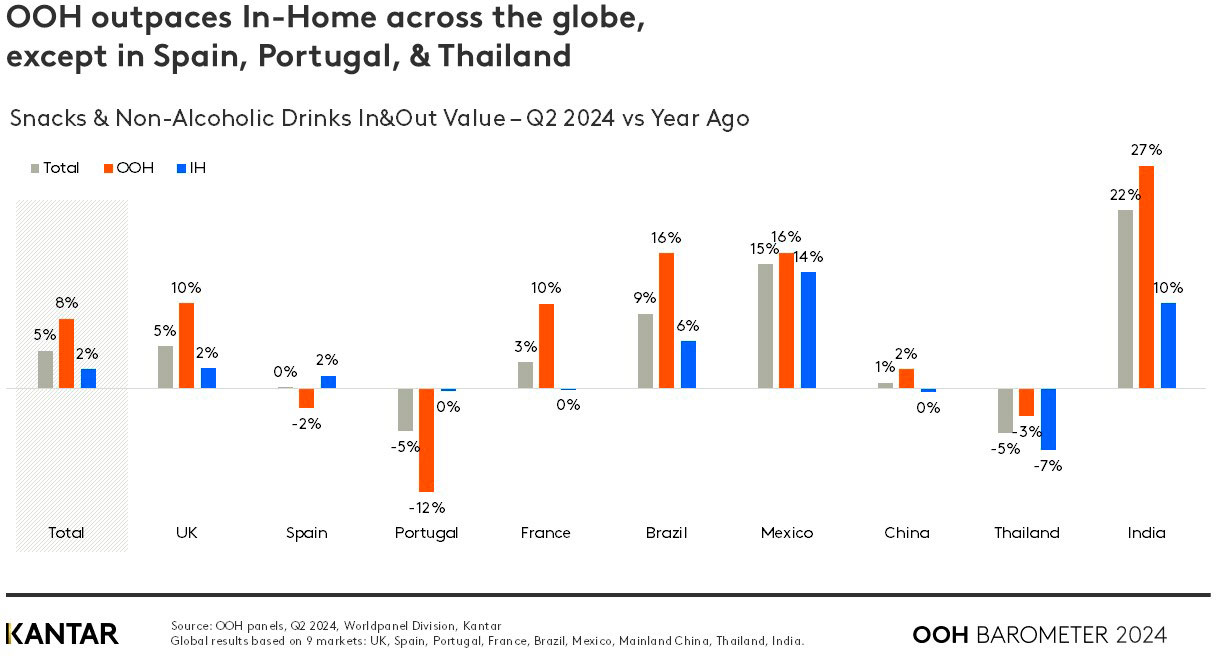

The global out-of-home (OOH) snacks and drinks sector continued to outstrip the performance of the in-home sector in the second quarter of 2024, with year-on-year value growth of 8% compared with 2% for take-home purchases.

This is the case in all markets covered by Kantar’s Worldpanel data, except for Spain, Portugal and Thailand. India saw the biggest surge in spend at 27%, followed by Brazil and Mexico.

The proportion of total ‘in and out’ value coming from OOH has risen for the 8th consecutive quarter, rising to 38% from 37% in Q2 of 2023. Growth was fastest in India, with an uplift from 68% to 71%. Only in Spain and Portugal has the OOH share dropped slightly, from 35% to 34%, and 39% to 36% respectively.

Spend has risen across all three OOH categories, compared with last year: snacking food (+9), non-alcoholic drinks (+8%), and meals. (+7%).

Growth is organic and incremental

The main contributing factor to this dynamic growth remains the rising number of trips consumers are making – although this is showing signs of slowing down, with an increase of 5% in Q2 compared with 11% during the same period in 2023.

It’s important to note that the growth of OOH is not putting in-home performance at risk. The total market is steadily growing in value quarter after quarter, despite inflation subsiding.

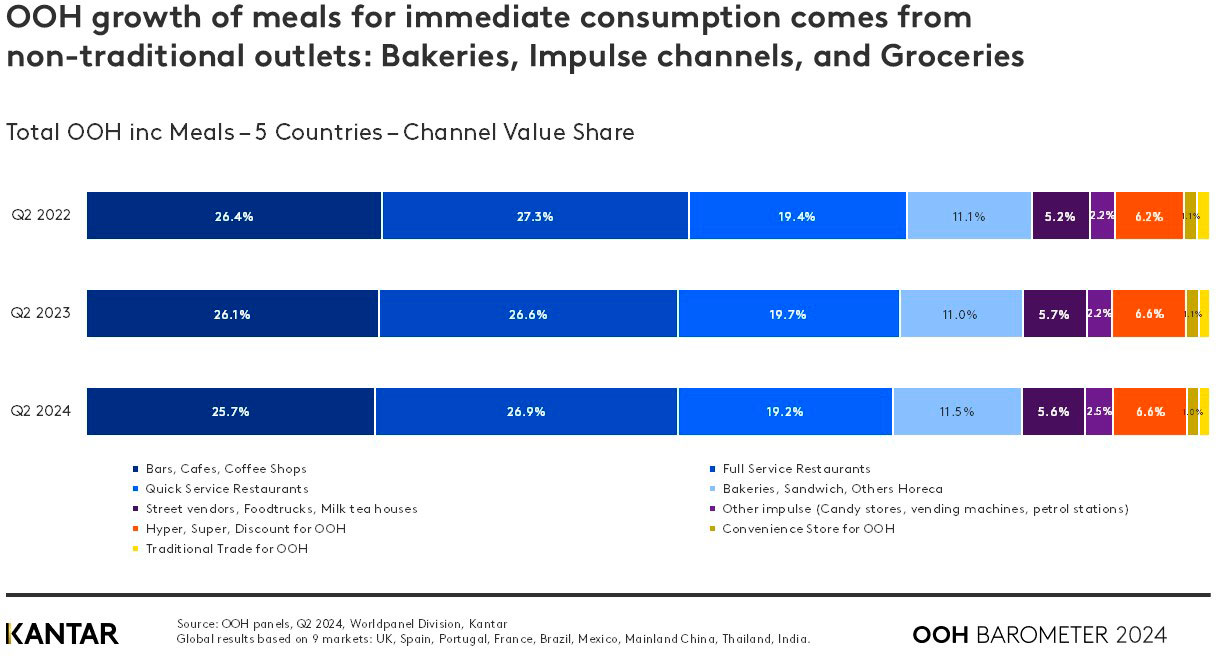

Diverse channels contribute to performance

Although bars and cafés are the main catalyst for this sustained strong performance, with a share of value that has grown from 8.5% to 9.2% in a year, traditional trade channels, bakeries and impulse channels have also gained ground.

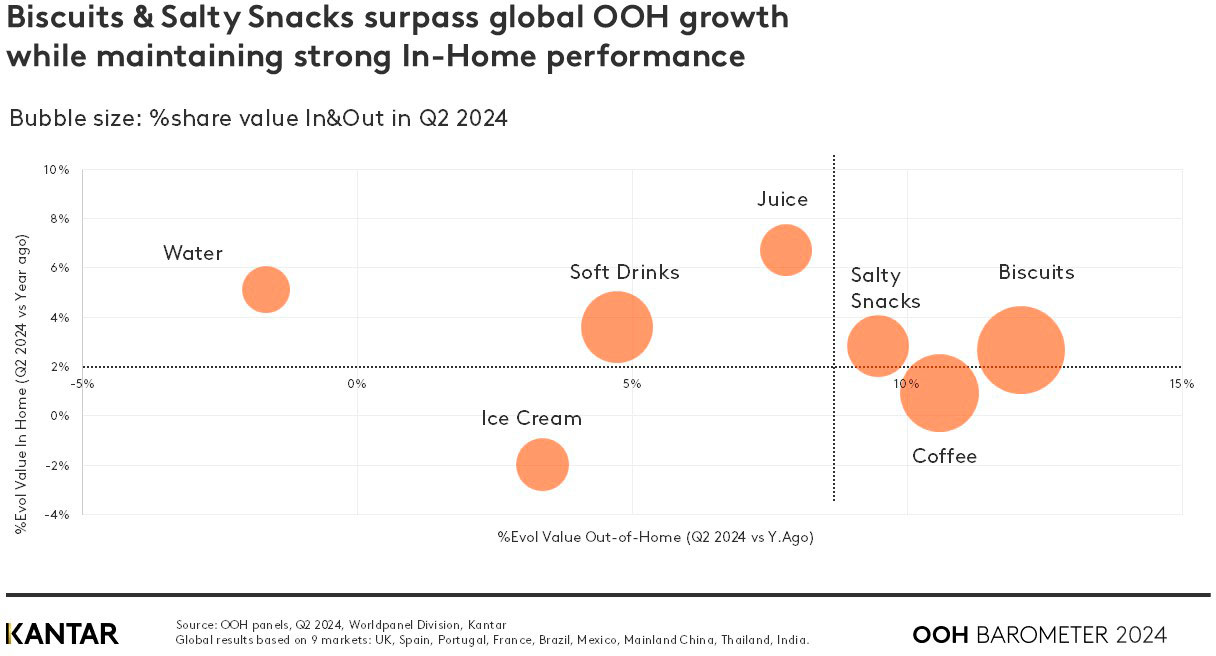

Biscuits and salty snacks stand out

Biscuits and salty snacks are once again the top-performers in OOH, with a 12% and 9% boost in value compared with last year. Both are growing at a faster rate than the overall OOH market – but their gains are not nibbling away at in-home sales, which have maintained a strong 3% growth in both categories.

Lay’s is the most chosen snacking brand OOH globally, according to Kantar’s Worldpanel Brand Footprint research. Over the last year, the favourite achieved a 0.5% growth in consumer reach points (CRPs) – a measure that combines data on population, penetration, and frequency to quantify consumers’ choices. More than half (50.9%) of Lay’s total CRPs come from OOH occasions.

Demand rises for freshly prepared meals

People are increasingly attracted to the purchasing of meals OOH for immediate consumption, as a convenient and affordable option. This is the case across all five markets Kantar covers for this category: the UK, Spain, Portugal, France, and Brazil.

Growth largely stems from outside of the traditional venues, such as full service and quick service restaurants, which have both experienced a slight drop in value share. Instead, driven by speed and convenience, consumers are heading to less formal channels – primarily bakeries, which have increased their share 0.5% in a year, groceries for immediate consumption (+0.4%) and impulse channels (+0.3%). Hypermarkets and supermarkets offering hot ready meals are becoming a popular choice, with 6.6% of the total spend.

Zooming in on quick service restaurants (QSR), this channel continues to hold the third highest value share at 19.2%. A consistently affordable and accessible option for consumers around the world, the top operators excel at winning new buyers, expanding their footprint, and finding new space in which to play.

In the UK, Greggs has increased its presence more than any of its QSR rivals, with an 8% increase in penetration since 2019. Alongside expanding its hot meals offer, it has opened 150 new outlets in the last five years. Burger King is the winner in France, meanwhile, gaining 5.3% penetration since 2020 through the launch of premium and vegan versions, and creating new occasions.

It’s now possible to say with certainty that consumers have returned to their pre-pandemic routines of snacking and drinking when they’re out and about. However, they have built new habits and preferences. Brands and retailers must track and understand these changes in behaviour to meet demand, and capture a greater share of market value.

Download the complete deck for further information and don’t hesitate to contact our experts.