The proportion of value contributed by out-of-home (OOH) sales to the global snacks and non-alcoholic drinks market continues to escalate – with a share of 38% in Q1 of 2024, up from 36% in the same quarter in 2023 and 34% in 2022. This brings the proportion close to the 60/40 split seen before the pandemic.

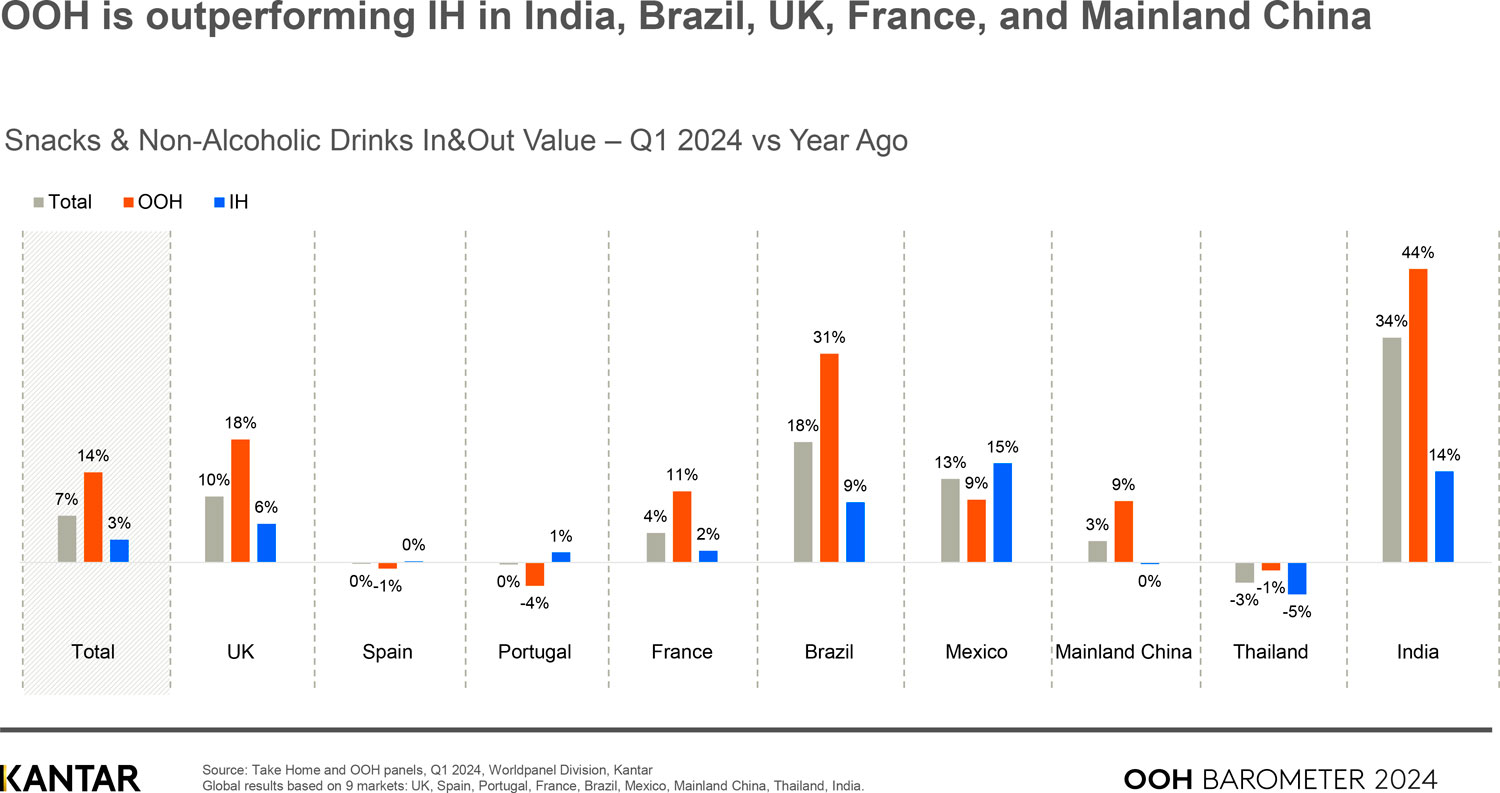

Growth in OOH snacks and drinks spend reached 14% in Q1 of this year, according to Kantar’s Worldpanel latest OOH Barometer study. This represents significantly faster growth than in-home (3%), emphasising how essential OOH sales are to the strength of the sector as a whole. India was the star performer, with OOH increasing its market share from 66% to 71% in the last year, driven by a huge 44% rise in spend.

Recovery trajectories vary across markets, with the countries covered by the Barometer splitting into two camps. OOH spend growth is outperforming take-home in India, Brazil, the UK, France, and Mainland China. Only Spain, Portugal and Thailand buck the trend: this is most likely because the OOH consumption habit was already well-developed in these markets.

The impact of inflation abates

In 2023, most of the value growth within snacks and drinks purchased to consume at home could be explained by escalating prices. This is no longer the case in 2024, with inflation having less of an effect across both in-home and OOH – where the impact had always been lower.

As inflation has eased, we can clearly see that the value increase within OOH is natural and organic, driven by people buying small snacks and drinks more frequently to consume out and about. Consumers made 9% more trips in Q1 of 2024 than they did during the same period last year, while volume increased by 3%. In parallel, price per unit increased 2% year-on-year – a marked slowdown compared with the 5% rise in Q1 of 2023.

Coffee shops, impulse channels and modern trade drive recovery

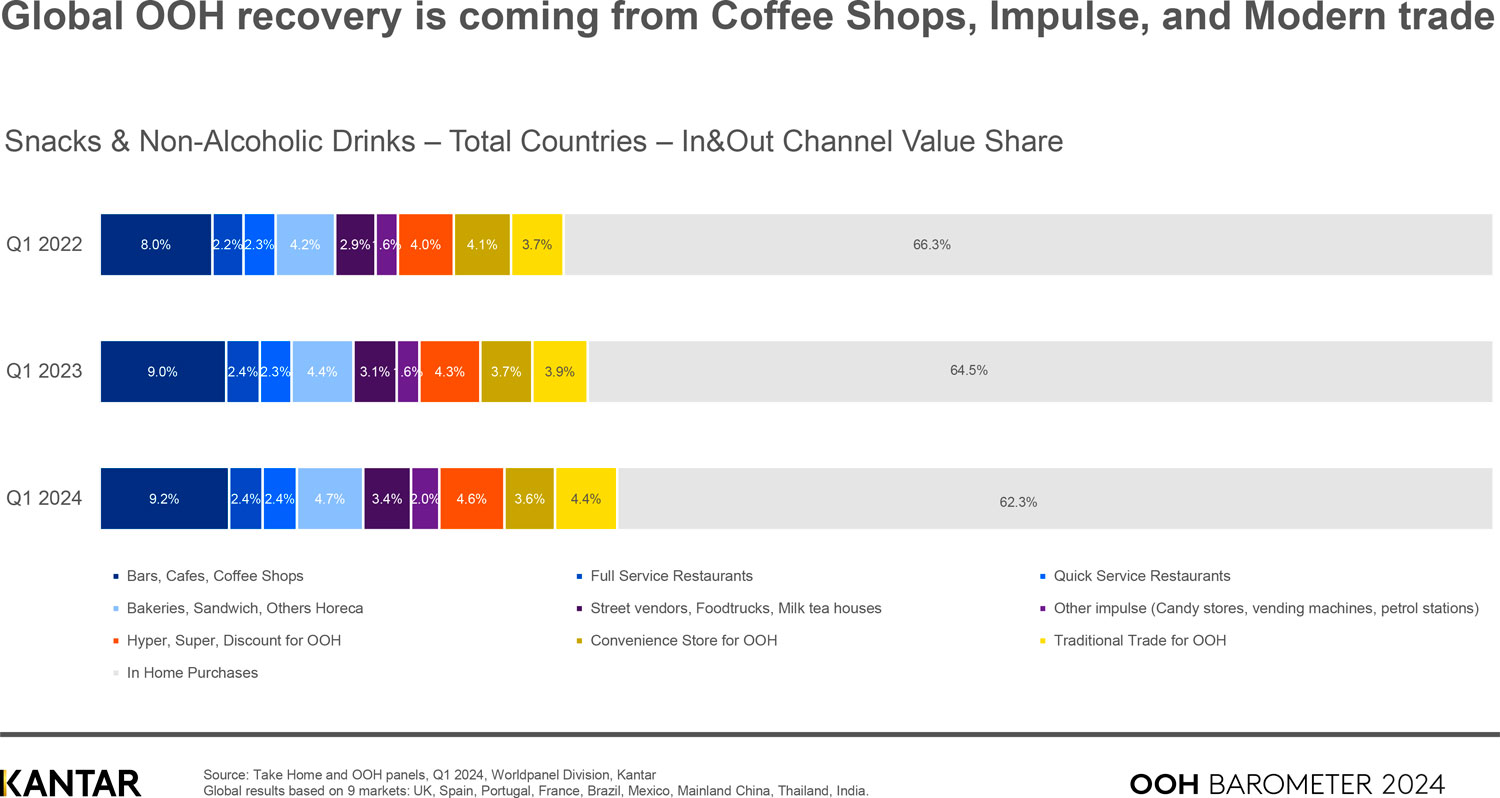

The channel landscape is returning to what might be called ‘normal’, if we refer to the picture that existed before the pandemic, although some behaviours are likely to have been changed forever. Over the last two years, the share of value deriving from in-home snacks and drinks sales – which surged during COVID-19 – has reduced from 66.3% to 62.3%.

Benefiting most from the recovery are coffee shops and bakeries, impulse outlets, and modern trade – hypermarkets, supermarkets and discounters. The strongest rise in share was seen among bars, cafes and coffee shops, with an uplift of 1.2%. This highlights the rising importance of ensuring that snacks and drinks for immediate consumption are present and available everywhere, including grocery stores.

Salty snacks and biscuits grow fastest

OOH value growth is now faster in snacking foods than in either drinks or meals in restaurants and cafes, due to the increase in popularity of buying meals to eat on-the-go. The big winners at the start of 2024 were the salty snacks and biscuits categories, with growth in OOH spend of 19% and 15% respectively.

This evolution has not come at the expense of take-home purchases; it is additional and incremental, boosting the success of the entire snacking category.

At a global level, Lay’s is the most-chosen snacking food brand for OOH consumption, according to Kantar’s Worldpanel annual Brand Footprint study. Kit Kat and Kinder have achieved the biggest growth in Consumer Reach Points (CRPs), Worldpanel’s measure for determining the most-chosen brands.

India’s love affair with snacking

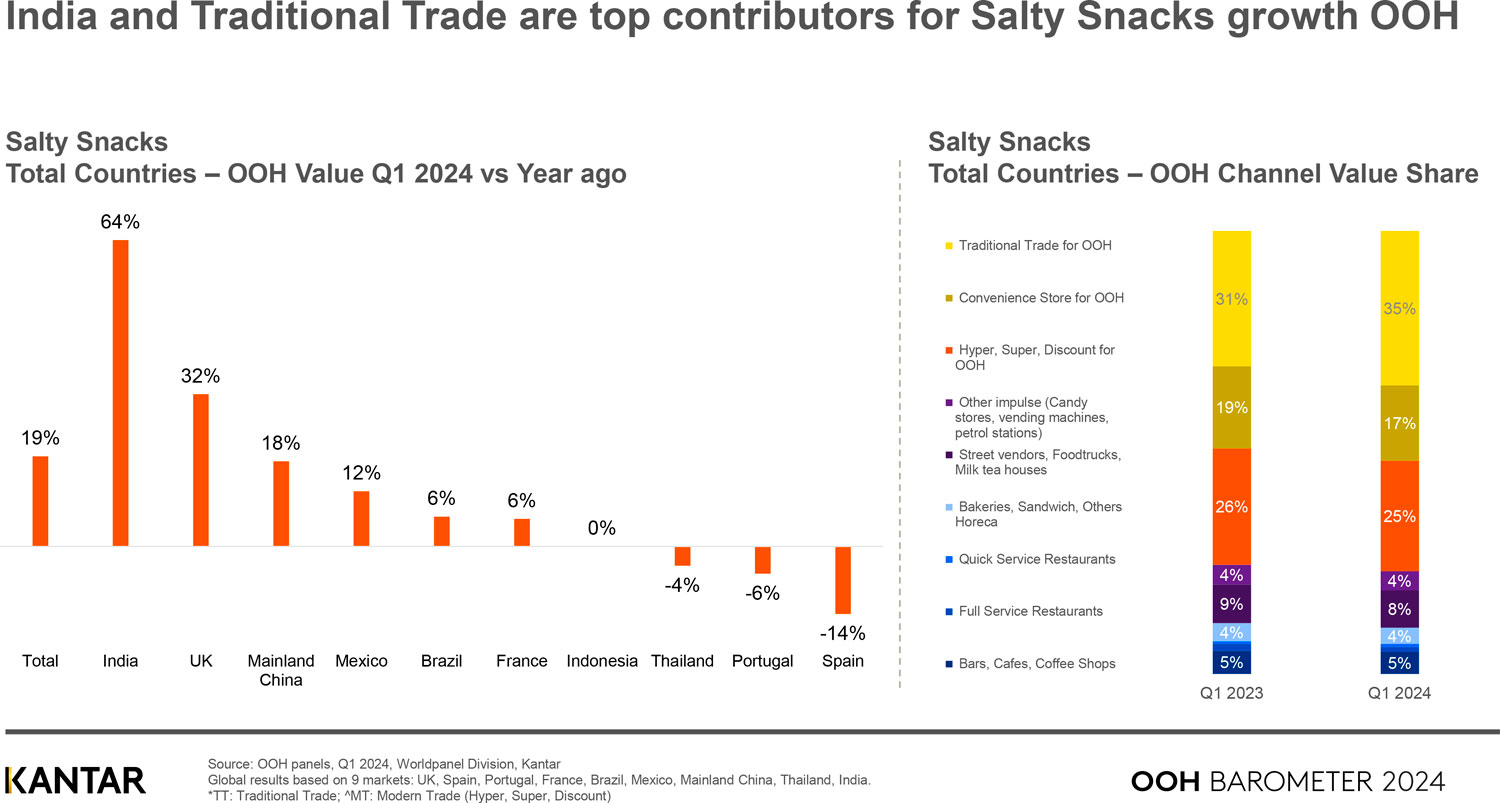

India (+64%) and the UK (+32%) are the chief catalysts for OOH growth in salty snacks. In India, snacking habits developed during the pandemic have become entrenched as a new part of everyday life.

Across all markets, traditional trade has seen the biggest uplift in spend within this category, from a 31% share of value in Q1 of 2023 to 35% in 2024 – having nibbled into the share held by convenience stores and modern trade.

The traditional trade channel rules supreme in India, where the success of snacks has transformed the FMCG market. This year there are six snack brands in the Brand Footprint Top 20 ranking, while those that have made the biggest jumps up the ranking also come from this sector, led by salty snack brand Bingo.

With penetration of 40%, Haldiram’s leads India’s savoury snack segment through continually finding new space in which to innovate and gain new buyers – one of the key drivers identified in Kantar’s Blueprint for Brand Growth.

As consumers continue to return to the habit of snacking and drinking when they’re out of home, the market will continue to grow in value, in spite of the slowdown in inflation. Brands and retailers must closely follow consumers’ purchase behaviours as they evolve, and target their strategies to the right occasions and needs to build volume and frequency.

Fill in the form below to download the deck with the full data and contact our experts for further information.