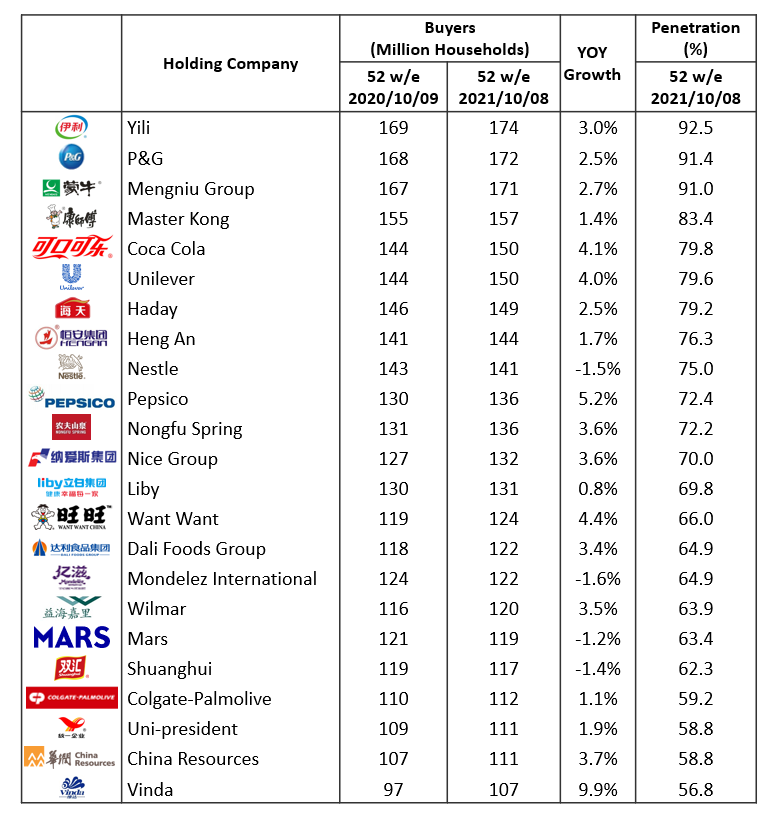

As consumers in China are adapting to the new reality of COVID-19 in 2021, they continued to reach for brands they trust. The latest study from Kantar Worldpanel indicates that 23 Fast Moving Consumer Goods (FMCG) companies attracted over 100 million urban Chinese households each during the 52 weeks ending October 8, 2021.

As a total, these companies added 74 million more households to their shopper base compared to the previous year’s 22 companies of “100 million family club”. Yili, P&G and Mengniu each attracted more than 170 million families in 2021. In terms of growth rate, Vinda is the top riser, with a 9.9% growth in their number of consumers year on year. This is also the first time Vinda has joined the ranking. Aside from Vinda, PepsiCo, Want Want, Coca Cola and Unilever are also top performers, reporting significant growth in their consumer base.

FMCG Companies Ranking by Consumer Base (million households)

The biggest players in FMCG continue to win the hearts and minds of Chinese consumers as they entered a new stage of development. We saw most companies cemented their position on the back of continuous innovation and broader brand portfolios. The market leaders’ enduring brand power are further enhanced as they have actively embraced the new reality and transformed the way to act on the new opportunities.

A world of new normal

Covid-19 has profoundly enhanced consumers’ consciousness towards health and wellbeing. Dairy players, such as Yili and Mengniu continued to hold on to their leading position, while Want Want managed to grow their consumers by 4.4% thanks to its dairy product line adding 9.2 million new families to its franchise. However, consumers are still looking for indulgence during a period of stress and anxiety. Therefore, companies offering fizzy drinks and ice cream brands, such as PepsiCo, Coca Cola and Unilever, added new consumers by attracting those looking for comfort and joy while spending more time at home.

On the non-food side, though the pandemic is mostly under control, demand for hygienic environment remained high. Consumers continued to stock personal and household hygiene products that are effective in protecting their families and this helped to boost the buyer base for P&G, Unilever and Vinda amongst others.

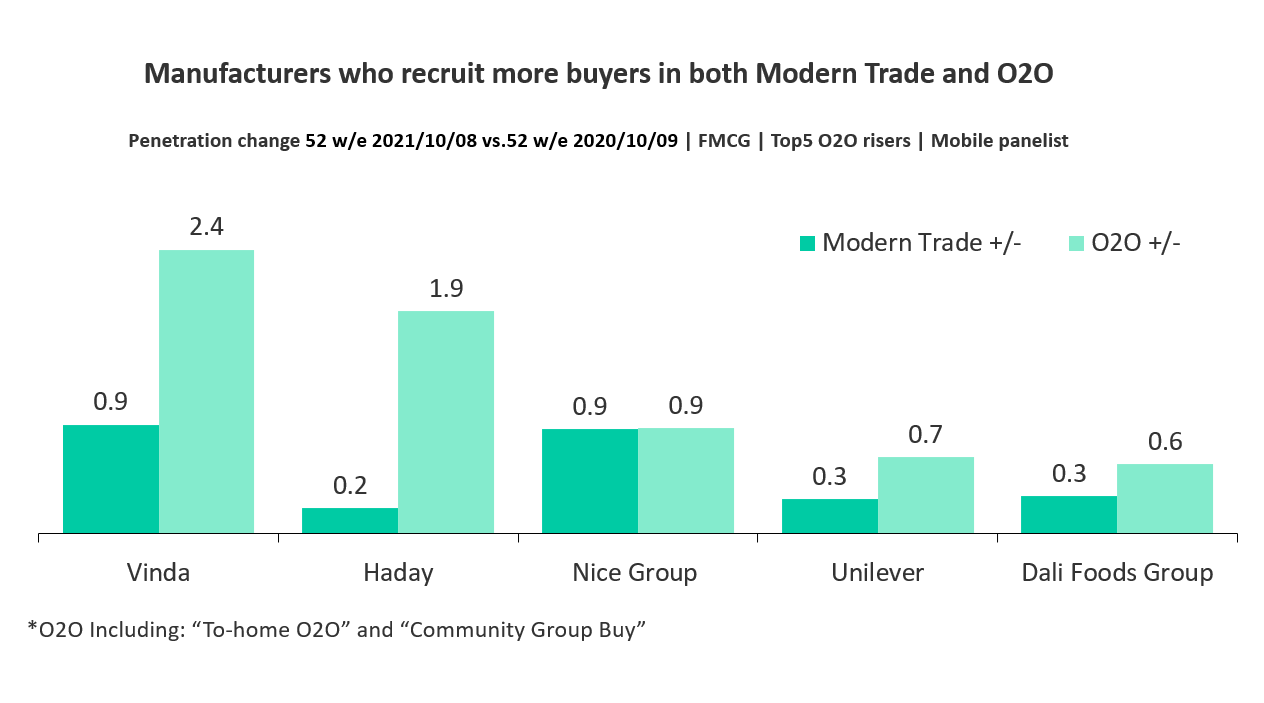

O2O – a new background to win offline

Digital channels* remained a crucial driver of FMCG growth in China. In the last 12 months to October 2021, 93% Chinese families bought FMCG through digital channels. While eCommerce continued to grow steadily, fuelled by new formats such as social commerce, live-streaming and short-video based commerce, the new O2O model (order online and receive delivery from an offline store) is rapidly transforming the shopping experience by connecting the vast user base of internet platforms and physical retail stores across the country. Leading national and regional retailers are able to achieve incremental growth through more efficient user recruitment and order fulfilment.

Over the past three quarters in 2021, 57% Chinese families ordered FMCG products through either major delivery platforms, retailers’ own APPs or Community Group Buy APPs. For major FMCG companies, O2O helped them to attract new shoppers and tap into new consumption moments as footfalls in the physical stores continued to decline.

Vinda, Haday, Nice, Unilever, and Dali are the top players to seize growth opportunities from digital channels, either by providing consumers with delivery options to satisfy their needs for convenience or providing on-demand services to fulfil immediate needs. Through extensive collaboration with O2O platforms, Haday managed to make their seasonal products available to consumers within 30 minutes as consumers decide to cook at home more often with attractive promotions, hence attracting more new shoppers to the brand.

Both Mengiu and Master Kong provided options of full-case pack milk and five pack instant noodle options through O2O platforms to offer consumers who want to have the hassle-free delivery convenience. Coca Cola, for examples, also built a strategic alliance with Meituan, under the strategy of ‘food+” to further tap into meal occasion opportunities.

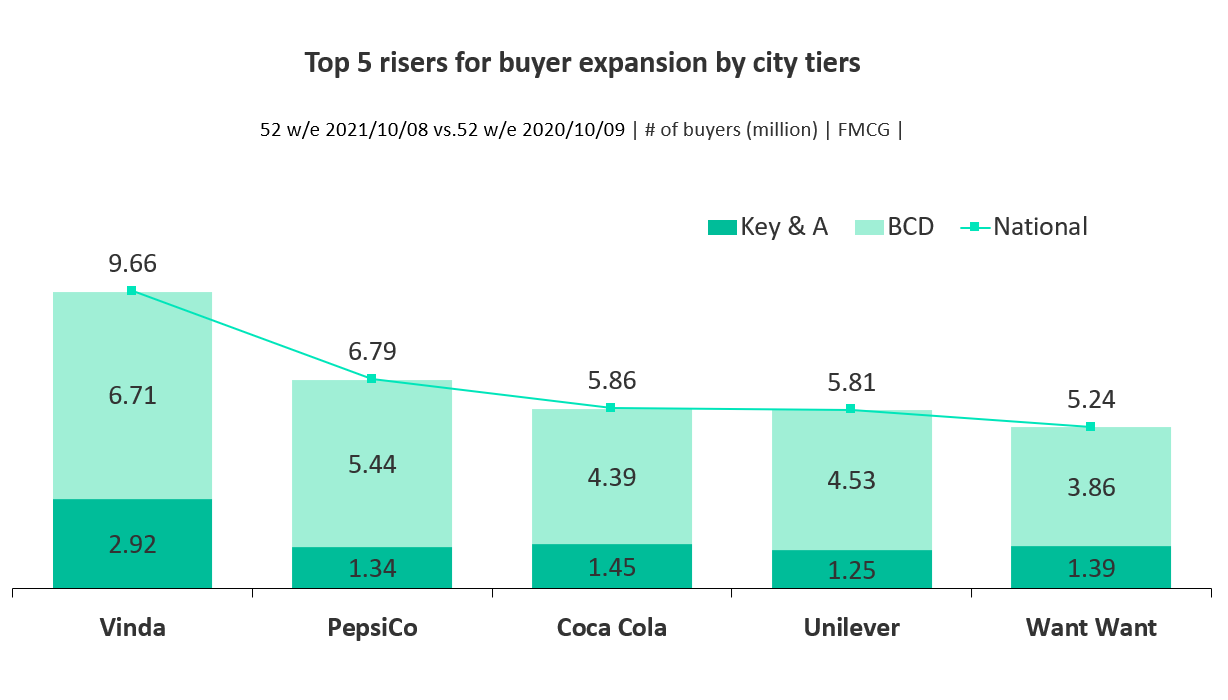

Winning new shoppers in the lower tier

As the Chinese economy changes gear, lower tier cities remain the growth engine for most FMCG players. With the development of short video and mobile commerce, lower-tier city consumers displayed a higher aspiration to adopt new lifestyles similar to their high-tier counterparts. Tier 3-5 cities saw a faster growth of 3.2% year on year in comparison to the smaller growth of 2.5% of tier 1-2 cities based on data to 52 weeks ending October 8, 2021.

To drive incremental growth in shoppers, winning players targeted lower tier city shoppers with the right offer and right way of value delivery. Analysis from Kantar Worldpanel suggests that across the top 23 companies, gains of shoppers in lower tier cities accounted for 73% of their overall buyer base expansion.

Vinda managed to recruit most new buyers from tier 3-5 cities as consumers upgrade their choice to buy more paper categories (e.g. wet tissues and kitchen rolls). In addition, Vinda also benefited from expanding its business to emerging categories like adult diaper to future proof its business. Over the past year, Vinda reached 6.3 million more families in tier 3-5 cities. PepsiCo also actively acquired 5.4 million new families in tier 3-5 cities with its successful strategy to penetrate into more small-format stores while driving more availability through eCommerce.

Notes to editor:

1. Kantar Worldpanel China continuously measures household purchases over 100 product categories including cosmetics, food and beverages and the toiletry/household sector. Its national urban panel covers 20 provinces and four municipality cities (Beijing, Tianjin, Shanghai and Chongqing).

2. International retailers refer to retailers originated outside Chinese Mainland, Taiwan, Macau and Hong Kong.

3. Mengniu includes Yashili, Biyou from Danone

4. Nestle includes Yinlu, Hsu Fu Ch and Totole

5. Mars includes Mars and Wrigley

6. Colgate includes Colgate and Darlie

7. Lower city tiers include prefecture level cities and county-level cities & counties.

8. China Resources exclude Vanguard and Pacific Coffee.

9. Modern trade Including Hypermarket, Supermarket(Including Large Super,Small Super,Personal Care Store)and CVS(including chained and non-chained CVS)

10. Digital channel: Including O2O and eCommerce.

O2O includes “To-home O2O” and “Community Group Buy”:

To-home O2O is the shopping journey starting from online platforms, leading to offline purchases and normally reaching consumers within 1 hour by delivery services

Community Group Buy is the shopping journey starting from online platforms (often with the presence of WeChat groups), assisted by group leaders in shoppers’ neighborhood, leading to offline purchases which are ready for pick-up next day at gathering points

eCommerce includes:

1) EC platforms include Taobao, JD.com,

2) Social commerce include RED, Weibo, WeChat store, WeChat moments

3) Short Video platforms include Douyin, Kuaishou