Consumer spending on FMCG in urban China grew by 3.1% in 2021, an increase of 3.7% compared to 2019. This illustrates how the market is gradually recovering from the impact of COVID-19.

The FMCG market grew by 2.3% year on year in Q4, driven by China’s famous annual ecommerce shopping events including Singles Day and Golden Week. This is slightly higher than the previous quarter, and reveals the resilience of the consumer market.

According to the National Bureau of Statistics, consumption contributed 65.4% of China’s economic growth in 2021, highlighting the importance of domestic demand. While uncertainties over COVID-19 continue, the FMCG market is set to attain a healthy growth again in 2022, helped by government initiatives designed to promote consumption, combined with brands’ efforts to improve supply.

A show of strength from Food and Beverages and personal care

In 2021, value sales within the food and beverage sector in China increased by 2.3%, with liquid milk and cheese growing well ahead of other categories. Ice cream and pet food continued to attract more new consumers.

Spend within the personal care sector was up 4.5%, fuelled by higher demand for products that enhance quality of life at home, and offer a more refined lifestyle – such as air fresheners, fragrances, clothing care products, hair care and mouthwash.

A downward trend in modern trade

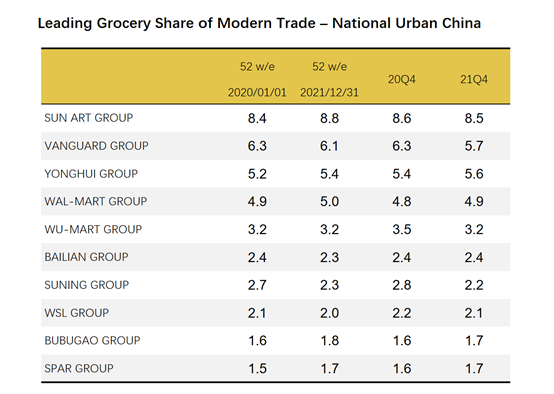

Value sales in modern trade channels – which include hypermarkets, supermarkets, and convenience stores – decreased by 1.5% through the year, mainly due to the continued downturn in consumer footfall in the large format channels. Sales in hypermarkets and large supermarkets dropped by 3.6% and 3.9% respectively.

In contrast, spend in small supermarkets grew by 6.7%, driven by rising shopping frequency. This trend indicates that small format proximity stores that serve communities and meet immediate needs are still favoured by consumers. Ecommerce growth slowed in 2021, but the channel still leads all retail formats with an increase in spend of 15.2%.

Although the emergence new COVID-19 variants in China had a significant impact on travel and social life, the steady rise in shoppers’ income, along with innovations in the retail supply chain, will continue to drive FMCG consumption upwards.

What’s in store for 2022?

The evolution of hypermarkets: better experience and greater efficiency.

Increased competition, multi-format development and changes in consumer lifestyles all led to a gradual decline in footfall and sales for hypermarkets in 2021. Kantar Worldpanel’s data shows that 67.8% of Chinese households visited hypermarkets, a decrease of 4.9% on the previous year.

In response, Walmart closed more than 30 hypermarkets, while local player Yonghui converted more than 50 into warehouse stores that offer affordable products and an optimised shopping experience.

In 2022, hypermarkets will move from ‘big and comprehensive’ stores that target all customer groups to an era of refinement and focus, with upgrading the customer experience a key priority.

Membership stores: the hottest format in modern trade.

Throughout 2021, China’s major retailors launched paid membership stores one after another. Walmart Group accelerated the expansion of Sam's Club with the opening of five new stores, and attracted 3.5% of the Chinese population. Freshippo, Metro and Carrefour also entered the format for the first time.

These stores are mainly located in first-tier cities such as Beijing and Shanghai, where families demand product differentiation, price performance and value-added services. These areas are about to become battlegrounds as purchase power rises and infrastructure matures, providing opportunities for expansion.

While charging for membership will secure short-term loyalty, long-term success will depend on retailers’ ability to bring value to customers, and provide innovative products based on an understanding of regional cultural and culinary habits.

Retailers will optimise the instant retail (O2O) experience.

After rapid growth during the pandemic, instant retail (O2O) continued its upward trajectory in 2021, driven by increased penetration and shopping frequency: 63.8% of Chinese urban households purchased FMCG through O2O services in 2021, shopping on average 11 times.

The food and beverage sector contributed nearly 70% of total sales, with dairy products becoming the most popular FMCG product bought on O2O platforms.

In 2021, platforms such as JDDJ, Meituan and Tao Xian Da launched one-day, half-day and even hourly delivery services, as well as offering personalised choices and more categories. Many transformed their warehouses and partnered with multiple instant retail service platforms to provide more convenient and efficient delivery.

This year, competition will reach the next level, with major platforms working closely with brands. Focus will shift to addressing specific market segments, needs and occasions, and from growing penetration to increasing basket size.

Community group-buying (CGB) platforms will review their business models.

CGB grew rapidly early in the pandemic, with major platforms investing heavily to expand their reach. According to Kantar Worldpanel data, 48.1% of Chinese urban families brought fresh food and FMCG products on CGB platforms in 2021.

However, some players withdrew from the market or merged with others as the model became less profitable, due to increased government regulation among other factors. The market also fragmented, with platforms such as Meituan Youxuan and DuoDuo MaiCai covering the national market, while others decided to focus on regional markets due to their advantages in local supply.

During 2022, CGB platforms will pay more attention to improving operational efficiency for the CGB ecosystem as a whole, and on providing a better service experience.

The resurgence of regional retailers will continue.

China's regional retailers enjoyed significant growth in 2021, through multi-format development and digital transformation. Jiajiayue, for instance, opened new hypermarkets, supermarkets, convenience stores and discount stores, as well as its first warehouse membership store.

This year, digitalisation, differentiation and multi-format development will remain the key to success for regional retailers. And there is room for growth: our data shows that the top 10 retailers in China only account for 38.6% of the overall modern channel, which is lower than in most Western markets.

To find out more, please reach out to our experts.