Alibaba has been crowned the most valuable brand in China for the first time in the annual BrandZ™ Top 100 Most Valuable Chinese Brands ranking, published today by WPP and Kantar in Beijing, having grown its brand value by 59% year-on-year to US$141 billion.

Despite China’s slower economic growth and international trade tensions, the total value of the BrandZ™ Top 100 Most Valuable Chinese Brands increased 30% to US$889.7 billion, the highest annual rise since the ranking launched in the year 2011. The growth has been fuelled by brands accelerating their expansion into China’s lower tier cities, which have seen rapid development and rising consumer buying power, and increasingly positive attitudes to Chinese consumer brands with a global presence.

Thirteen of the 24 categories increased in value, with Entertainment seeing the largest year-on-year growth of 186%, followed by Education (57%) and Retail (55%). Technology accounted for more brands than any other categories in the Top 100 (11), contributing 26% of the ranking’s total value and dominating the top 10 leaders in terms of Overseas Presence with six brands – double the number of last year. These include telecom and smartphone giant Huawei (No.6, US$33.2 billion), smartphone maker Xiaomi (No.11, US$20.6 billion), Lenovo (No.47, US$2.9 billion), the world’s largest drone-maker DJI (No.50, US$2.8 billion), ZTE (No.72, US$1.2 billion) and robot company UBTECH (No.85, US$910 million).

The study, expanded in 2019 to include four new categories – consumer finance, entertainment, lifestyle platforms and transport – reveals how the digitisation and sophistication of Chinese consumers is creating a unique marketplace of products and services available with unprecedented speed and convenience. Innovators in AI, e-commerce, New Retail and social media perform strongly. The fastest rising brands are video streamers iQiyi (No.28, US$5.6 billion) and Youku (No.31, US$5.0 billion), up 158% and 136% in value respectively. For the first time, the ranking also incorporates unicorn brands based on their most recent valuations publicly available to reflect the dynamism of the Chinese market and the impact of these brands.(See “Notes to editors”)

Xiaomi, services booking app Meituan (No.13, US$19.9 billion), food delivery app Ele.me (No.24, US$7.3 billion) and consumer finance brand Lufax (No.26, US$6.9 billion), which specialises in peer-to-peer lending, are the most valuable brands among a record number of 17 newcomers to the ranking this year. Their success, according to BrandZ™, has been driven by a mobile-centric, convenience-driven Chinese lifestyle.

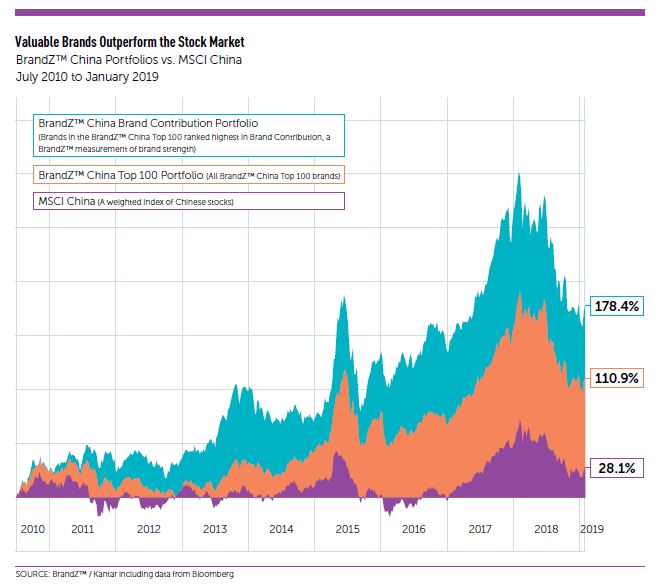

David Roth, WPP, says: “China’s stock market volatility over the past year has provided a real-life stress test for valuable brands, which continued to outperform the market. Put simply, valuable brands deliver superior shareholder returns. US$100 invested in the MSCI China Index in 2010 would be worth around US$128 today. That US$100 invested in the BrandZ™ China Top 100 would now be worth US$211. The threshold to enter the BrandZ™ China Top 100 has more than doubled from US$311 million in 2018 to US$681 million in 2019, demonstrating the continued pace of growth for Chinese brands increasingly recognised as leading the way in innovation. Against a backdrop of heightened competition and disruption, building stronger brands is what it takes to stay in the game.”

Alibaba’s brand value has grown 136% over the past five years in BrandZ™’s Top 100 Most Valuable Chinese Brands, outperforming the Top 100 overall which increased 92% over the same period. Since first appearing in the ranking in 2015 following its IPO, Alibaba’s rise to the number one spot in 2019 reflects the growth of a brand which has contributed to transformational changes in the Chinese market. In BrandZ™’s “Brand Power” metric of brand equity, Alibaba scored particularly strongly for being “Meaningful”, suggesting the brand known for coining the term “New Retail” has successfully created closer connections with its consumers.

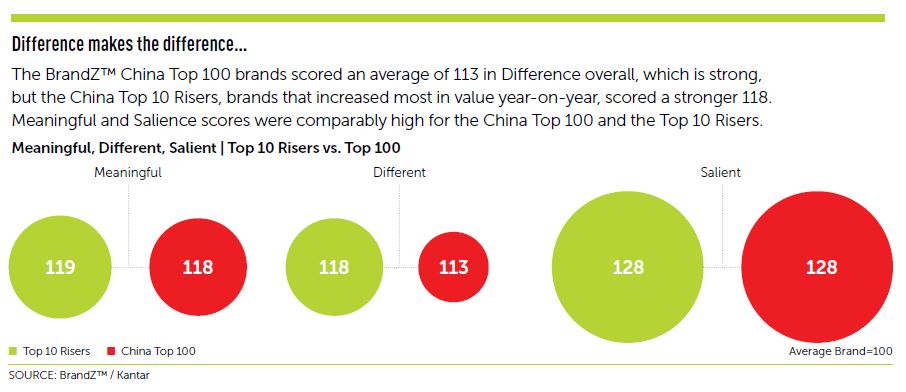

The Brand Power metric also looks at how brands perform in being Different (distinctive), and Salient (coming to mind at the moment of consideration). While Chinese brands generally score well for being Meaningful and Salient, they do not perform as well in being viewed as truly distinctive from the competition or as trendsetters.

Doreen Wang, Global Head of BrandZ™ at Kantar, adds: “Whether going abroad or expanding domestically, the potential for brand growth is huge for China’s most valuable brands. But realising it requires the knowledge and expertise needed to surmount new challenges. This report highlights the importance for Chinese brands to build difference in the domestic and global marketplace.”

The BrandZ™ Top 100 Most Valuable Chinese Brands report is based on a deep understanding of what motivates consumers, how to fulfil their expectations and how to build powerful and valuable brands that consumers and investors love. The full report along with charts and videos can be found here or via the app, available for download by visitiing www.brandz.com/mobile, or download BrandZ™ app from iTunes or Google Play. All BrandZ™ valuation results are also available for Bloomberg subscribers at their fingertips.

- BrandZ™’s top-five 2019 takeaways for building valuable brands in China:

- Build difference – As the China market becomes even more competitive the importance of Difference increases

- Go deep – China is growing fastest in lower tier cities; relying on insights gained from competing in coastal metropolises can help – but can also create misunderstanding

- Refine the brand experience – Standing out from sameness requires delivering a memorable brand experience by personalising one or more aspects of the brand

- Be intelligent – To produce the extreme convenience lifestyle favoured by Chinese consumers, the path to success involves a combination of human and artificial intelligence

- Build a powerful brand – At the point of sale – physical or online – a powerful brand enjoys an important edge against all other brands trying to convert consumers to customers.

EDITOR'S NOTES

* Background and methodology

Commissioned by WPP, the valuation behind the BrandZ™ Top 100 Most Valuable Chinese Brands was conducted by brand equity research experts Kantar. The methodology mirrors that used to calculate the annual BrandZ™ Top 100 Most Valuable Global Brands ranking, which is now in its 13th year.

The ranking combines rigorously analysed market data from Bloomberg with extensive consumer insights from over 3.7 million consumers around the world, covering more than 166,000 different brands in over 50 markets – including opinions from nearly 290,000 Chinese consumers on over 1,100 brands in 75 categories.

The ability of any brand to power business growth relies on how it is perceived by customers. As the only brand valuation ranking grounded in consumer opinion, BrandZ™’s analysis enables Chinese brands to identify their brand’s strength in the market and provides clear strategic guidance on how to boost value for the long-term. The eligibility criteria are:

- the brand was originally created in China

- the brand is owned by a publicly traded enterprise, or its financials are published in the public domain

- Bank brands derive at least 20 percent of earnings from retail banking

- Chinese unicorn brands have their most recent valuation publicly available. (In prior years, only publicly-traded or audited companies were eligible).

The suite of BrandZ™ brand valuation rankings and reports includes Australia, China, France, Germany, India, Indonesia, Italy, Latin America (Argentina, Brazil, Chile, Colombia, Mexico, Peru), The Netherlands, South Africa, Spain, UK, US.

* To reach the author, or to know more information, data and analysis of national and city brand consultancy in China and other parts of the world, please contact us.