Take-home sales at the grocers increased by 1.8% over the four weeks to 23 March 2025 compared with one year ago – the slowest rate since June last year, according to our latest data. Grocery price inflation rose slightly to 3.5% over the same period.

With prices continuing to rise, supermarkets are mindful of the need to invest to attract shoppers through their doors. Promotional sales ramped up this month to 28.2% of total grocery spending, the highest level we’ve seen in March for four years.

Retailer’s price cuts were responsible for £2.6 billion of promotional spending, 8.8% more than the same time last year and significantly higher than the £686 million spent on multibuy deals and ‘extra free’ offers. Despite the recent surge, we’re still some way off the promotional records hit in the wake of the financial crisis. Average spending on deal in 2012 was 39.8%, meaning there could still be more headroom to go. However, the market has changed a lot in that time, with the discounters holding a far higher share today than they did 13 years ago.

Many households still struggling financially

Retailers’ battle to deliver value will be welcome news for households who remain worried about their financial situation. While the number of people reported as financially struggling has fallen from its recent peak*, this still accounts for almost a quarter (22%) of the country. The rising cost of groceries ranks third on the list of concerns keeping consumers awake at night, just behind energy bills and the country’s overall economic outlook.

Our data explores the changing nature of the in-store experience as retailers adjust their strategies. There were 200,000 fewer visitors to supermarket cafés** over the course of the last year, with these outlets now accounting for just 0.3% of spending in the grocers. They do, however, remain popular, with nearly 12 million of us popping in on at least one occasion in the past 12 months.

In the face of ongoing sensitivities around personal finances, consumers are continuing to find a way to treat themselves. Despite Easter not falling until late April, sales of chocolate eggs and other seasonal confectionery totalled £134 million last month, while hot cross buns were enjoyed by over a third of households.

Aldi and Ocado reach new share highs

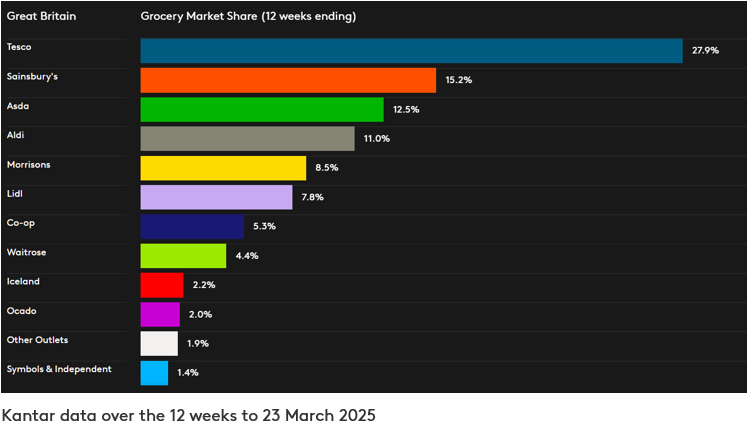

As Aldi prepares to celebrate the 35th anniversary of its first UK store opening on 5 April, its share of the grocery market has hit 11.0% for the first time. This is up 0.3 percentage points from last year, and its sales grew by 5.6% - the fastest rate for Aldi since last January.

Lidl’s sales rose by 9.1%, taking its market share to 7.8%, 0.4 percentage points higher than one year ago. Lidl attracted 385,000 more shoppers last month, more than any other grocer, and it saw a double-digit rise in footfall.

Ocado was again the fastest growing grocer, a position it has held for the last 11 months, as its sales increased by 11.2%. For the first time, the online retailer took a 2.0% portion of the market. Spending on groceries at M&S*** increased by 13.1%, on top of M&S goods sold through Ocado.

Tesco boosted spending through its tills by 5.4%, nearly half a billion pounds more than the same period a year ago. Britain’s largest grocer made the biggest share gain, with its portion climbing from 27.3% to 27.9%. Sainsbury’s reached 35 consecutive periods of year-on-year growth, with sales up by 4.1% as it grew ahead of the market. Its share nudged up to 15.2%.

Sales at Morrisons were 0.6% higher and its stake of the market stands at 8.5%. Asda holds a 12.5% share. Spending through the tills at Waitrose grew by 2.7%, maintaining its 4.4% share of the market. Take-home sales at the Co-op were up by 1.0% with the convenience retailer now holding a 5.3% share. Iceland’s hold of the market is 2.2%, and its sales increased by 1.8%.

*In October 2022, 27% of those surveyed believed they were ‘struggling’ financially. Source: Kantar Panel Voice ‘pressure groups’. 10,403 panellists interviewed between 31st January – 10th February 2025.

**Source: Kantar - Out of home panel. 52w/e 23 Feb 2025

***Please note: with a higher proportion of clothing and general merchandise in its sales mix, M&S does not fall under the definition of ‘grocers’ using the Till Roll methodology on which the Kantar Grocery Market Share release is based. For this reason, a comparable market share number is not provided for M&S. The M&S growth number quoted in this update is for FMCG sales only, while the figures for grocers in the Grocery Market Share table cover total spending through supermarkets’ tills.