This is the first of a series of articles that explore the theme of brand equity – what it is, how to measure it, how to build it, the impact of media investment on it, the role of brand positioning as a solid foundation, all of which contribute (or should at least) to the making of one’s brand strategy. First stop in your journey: ‘what is brand equity’ and how to clear the pandemic fogginess that’s currently around it.

A short history of branding

Branding is about making your mark; without differentiation, everything is identical. Back in the 1500s (or some would say, even further back in ancient Egypt), it was all about making your mark – literally – with brand marks on cattle. Much, much later (if there’s anything Mad Men’s Don Draper taught us), the golden age of marketing cemented ‘instant associations’ as the winning formula for brand growth – i.e. making your mark figuratively.

This network of associations in people’s heads makes a product’s assets – verbal, visual or auditory – distinctive; these associations trigger an instant recognition that acts as a shortcut to brand meaning. There are some of those assets we would instantly recognise, even if we could only catch a glimpse of them, even if they were not fully formed. Think of strong brand mnemonics like Apple’s half-eaten apple, McDonald’s golden arches, Mastercard’s deep association with the word ‘priceless’, Intel’s three-second audio – someone, somewhere in the world plays that tune every five minutes, so it’s no wonder it’s entrenched in our minds.

An instantly recognisable brand is not always the chosen one though. It’s the power of brand equity that is revealed in people’s choice, which often is the tipping point between a brand and its competitors. And it all starts with power in the mind of the consumer, one’s predisposition towards a brand.

Power in the mind: the persistent nudge called predisposition

People and brands live and interact alongside each other. People form thoughts and feelings, gather facts and anecdotes, experiences, frustrations, even hopes towards a product or a service. It’s these cumulative associations that will steer their decision in a purchasing situation. Or, simply put, it’s the sum of all positive and negative attitudes and experiences that a consumer has developed towards a brand that defines whether they will ultimately pick it (often, again).

Predisposed consumers will find themselves inclined to:

- buy with less reminding

- overcome market obstacles to obtain that brand

- pay more for it

- be more likely to tell others about it

- be less influenced by competitive advertising.

Over the last decade, companies have increasingly invested in activation, targeting and incentivising buyers in their category. Our analysis finds though that two-thirds of growth comes from people who are already predisposed to choose a specific brand. Fulfilling that predisposition is less a matter of discounts and promotions and more about ensuring a brand is easy to bring to mind and easy to buy.

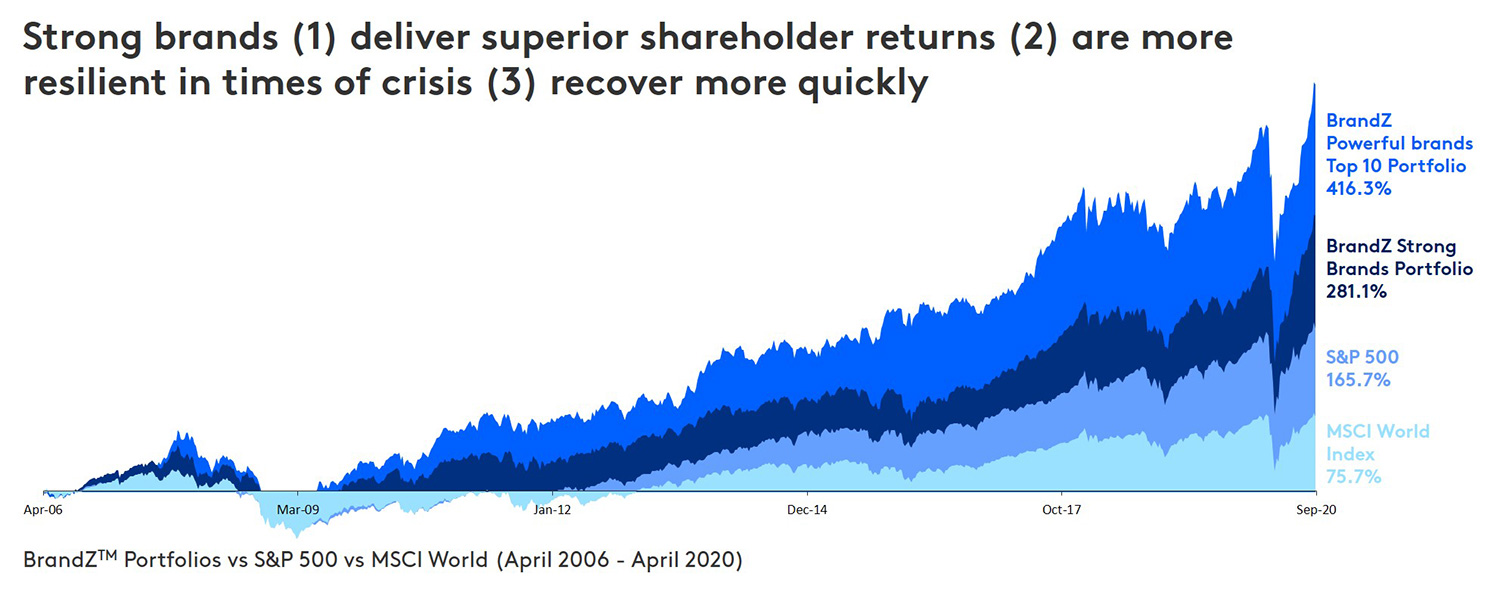

Survived (or even thrived) during last year’s storm? Your brand equity had something to do with it

Brand equity is the core element of your brand strength. In good times and tough times, strong brands win. In good times, strong brands grow value faster; in tough times, strong brands recover faster. BrandZ research provides evidence from two crises – the 2008 Great Recession and the current pandemic. And although history hasn’t repeated itself exactly, it’s proven to be an important guide. Following the financial crisis of 2008, strong brands recovered almost three times faster within two years... and over the last year, it is the strong brands again that have managed to stave off the worst of the crisis – growing in value against a backdrop of uncertainty.

Brand strength is key. During the height of the pandemic, luxury brand sales declined precipitously in China. But when the market reopened, pent-up demand for these brands popped up like a jack-in-the-box. The primary factor for this was the power of the brand, in this case, that of the luxury category, which tends to enjoy strong brand equity in China. So, strong brand equity adds resilience.

Knowing your brand equity, how to measure it and how to build it, is the foundation for success. We will explore both themes in the upcoming articles of the series.

It takes more than luck to build irresistible brands.

Our meta-analysis of growth drivers shows that brands with strong clarity (i.e. the extent to which what a brand stands for is universally understood and perceived by consumers) contribute 70% more to sales. Clearly, meeting consumers’ functional and emotional needs (i.e. being instantly meaningful) offers a commercial advantage to a brand. But is this enough to maximise growth? The biggest success stories come from brands that are meaningfully different; those that stand out and then stand for something.

Jeremy Bullmore once said: “People build brands as birds build nests, from scraps and straws we chance upon.” Consumers construct their perceptions of brands from their own experiences, moments, trials, ads, in essence, all the clues that brand owners lay out in front of them. But brand owners can’t leave this to chance – their brand building needs discipline, it needs a framework that provides focus at every stage of the journey; from defining and refining/resetting brand strategy to guiding effective development and getting implementation right.

Using Kantar’s NeedScope, brand owners are making the most of every brand encounter, ensuring their brand’s essence consistently permeates and connects everything they do. Precisely how it drives meaningful difference and fuels a brand’s growth, we will explore in another upcoming article of the series.

The bottom line: Brand equity has a strong relationship to sales – both in the short and the long term

“But nothing ever moves” was a common observation in traditional survey brand trackers. KPIs, wave after wave, only shifted marginally. So, understandably, and fuelled by the abundance of digital and behavioural data, over the last few years there has been a concerted push for a narrower range of KPIs that have a proven relationship to financial outcomes. Which made marketers more commercially credible in the boardroom and their activities generating a definite sales return. For the short term, that is.

And I will explain: the drive for evidence-based KPIs pushed marketers towards activity with ROI that’s easier to demonstrate (short-term sales or digital click-through behaviours) as opposed to activity with potentially the greatest ROI (longer term growth and sustainable profitability). Binet’s and Field’s 60% brand building/40% sales activation* harmonic ratio is enjoying universal acclaim and their work of genius is now even featuring in modern job descriptions: “You’ll be responsible for developing an end-to-end marketing strategy, applying brand building and activation marketing approaches such as Binet and Field to develop and activate plans for (…)”. So, in principle, everyone is in agreement. But, “It’s groundhog day in most marketing departments,” as Mark Ritson puts it. “They never get to make money because they are trapped, paradoxically, in an ROI cycle, which delivers less money over the long term.”

Over the last few months, businesses worldwide, have taken multiple approaches to overcome the crisis and mostly focused on reducing fixed costs and discretionary spend; marketing, communications and media** were the hardest hit, as it was revealed in Kantar’s Global Business Compass. Which put even more pressure on marketers to appear impactful within the year’s planning cycle and the already malfunctioned pendulum swung even more towards immediate ratification – short-term sales activation.

With the overhaul of spend remaining, how can one combat short-sightedness and improve their brand’s chances of achieving sustainable growth?

Ka-ching… a first taster of game-changing metrics

If only there was a set of proven indicators that can monitor and guide performance in the immediate short term, whilst, at the same time, signal if your brand is on track for longer term sales success. Well, there is. Mental availability/salience (not to be confused with awareness***) has been established as the foundation of brand tracking and equity research that has also a proven relationship to long-term sales. By no means the only one, but what Byron Sharp (in 2012’s ‘How Brands Grow’) calls ‘mental availability’ is a crucial determinant of whether people will buy (or not) a product/service, hence very relevant regardless of a marketer’s short-term or long-term focus.

Recent industry thinking, notably from the Ehrenberg Bass Institute, has further enhanced our understanding of mental availability/salience. Detecting the early signals of how easily your brand can come to mind when prompted by a relevant need or occasion will drive sales growth today and demand for tomorrow.

Please get in touch to discuss the full set of proven indicators for brand growth, and how we can help you build your brand equity. And watch this space as our brand equity series unfolds; over the course of the next few months, we will be releasing articles on all things brand equity addressing the themes raised here and more.

Notes

*for FMCG and varies by category

**Effective advertising is a critical mechanism to help build brands in the long term, as well as drive sales in the short term. This year’s Creative Effectiveness Awards highlights winning tactics and The 5 Habits of Highly Successful Advertisers

***Brand salience is the degree to which a brand comes to mind in a buying situation. Awareness is simply what brands come to mind when consumers are asked to recall brands within a category.

Kantar has appeared as a guest speaker on Mark Ritson’s Mini MBA programme for Marketers presenting our aligned thinking on ‘Measuring what matters and what moves’.