What can you do to ensure you maximise the return on your “brand equity”? What can you do with your brand assets, even in times of reduced budgets, to minimise the impact on sales, today and tomorrow?

1. Brand equity matters.

We know that strong brands driving more underlying sales from their equity are over twice as resilient to stock market shocks like the coronavirus pandemic, and we anticipate they will recover more quickly too.

Looking at 50 brands and cross referencing them with 16 companies that are publicly listed, we see that those whose brand equity contributed strongly to underlying sales saw a share price drop of 10.4% Jan to March. This compares to a drop of 23.8% for brands where that wasn’t the case.

2. Clarity is crucial to brand equity.

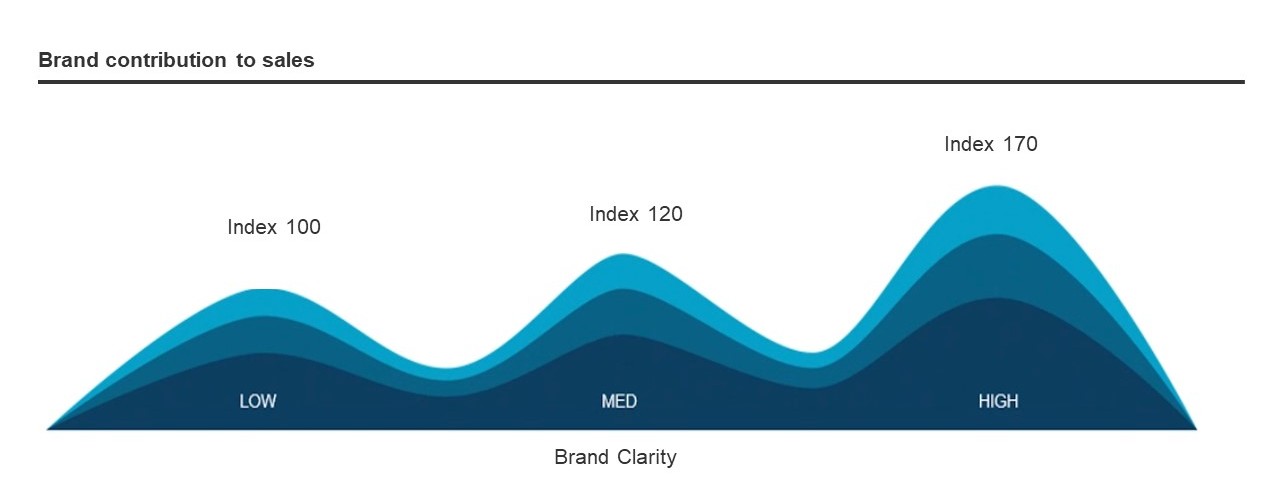

We know that brands with strong clarity generate more sales through their equity.

The importance of having a clear positioning is nothing new, but doing this consistently across the wide gambit of touchpoints – both managed and unmanaged – is the new battle. Those brands that do achieve a high brand clarity score are able to achieve a 70% higher brand contribution to sales than those brands that achieve a low clarity score. They can also rely less on pulling short-term levers such as discounting.

A great example of this is pharma brand Nurofen, who have been consistently driving a much stronger emotional connection with consumers via claims of consistent superior efficacy (“longer lasting relief”) and expertise (“recommended by experts”). This lets it demand a premium (“leading”) positions versus competitors and own-label brands, and generate a higher return on its equity.

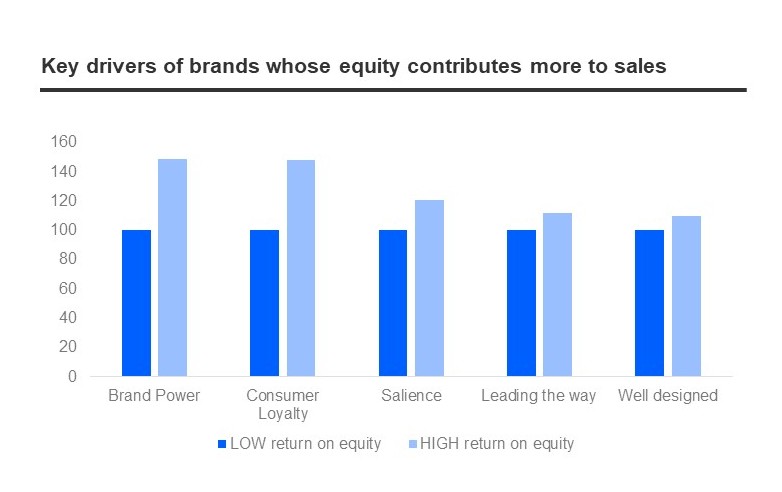

Our analysis shows that brands where brand equity contributes more to sales have comparatively higher Brand Power, Saliency and Loyalty versus others. Consumers see these brands as leading the way and being well designed, which prompts repeat purchase and loyalty.

3. You need to deliver on changing needs faster

Our analysis also shows that brands where brand equity contributes more to sales have created a strong connection with their customers. As we have seen, consumer behaviours and attitudes are changing rapidly as a result of COVID-19. So how should brands respond to these new needs whilst also maintaining their overall brand clarity?

For a leading UK insurance provider, we examined the way underlying consumer relationships were driving Brand Power before and during the UK coronavirus outbreak (Dec-Feb vs Mar-May). In just three months, the connection between ‘Customer Service’ and ‘Brand Power’ had increased by 29%, leading to ‘Customer Service’ becoming 6 percentage points more important overall. Our norms show that we are seeing a change in just three months that would normally be observed over a period of 12 months or more.

Brands need to better understand if they are maximising their return on equity by monitoring & responding to their customer needs with clarity and purpose through these unprecedented times.

Conclusion

Brands who can use their equity to drive sales are more likely to survive and indeed thrive following the shock of COVID-19. Unsurprisingly, it is stronger brands – those with more power, saliency and loyalty, and in particular strong clarity – who are able to generate more sales through their equity, and need to rely less on short-term levers such as promotions and discounting. They must also nurture a strong connection with their customers, which means responding to their changing needs, quickly. Those brands are best placed to maximise their return on their equity for today’s sales and tomorrow’s brand demand.