Take-home sales at the grocers grew by 4.8% over the four weeks to 7 September versus last year, according to our latest figures. Like-for-like grocery price inflation dipped slightly for the second consecutive month to 4.9%.

Prices might not be climbing quite as quickly, but they’re still on the rise and the battle between own-label lines and brands continues as household finances remain tight. Supermarkets’ own lines now make up 51.2% of all sales, up from 50.9% a year ago. Sales of these products grew by 5.9% this period, just ahead of brands at 5.3%, but it’s the premium own label goods which are the real standout performers. Sales rose by an impressive 10.3% making it six months in a row that they’ve increased by double digits. However, brands are holding ground in some categories, including toothbrushes, frozen chicken and baby toiletries, showing that consumers still value well-known names across some very different parts of the store.

Back to school

Autumn signalled a return to work and school for many households, impacting what people bought at the supermarket. People often start with good intentions and our data shows that this period is the most popular point in the academic year to bring a packed lunch to school.* In the two weeks to 7 September, sales of lunchbox staples shot up among families with children compared to the previous fortnight. Spending on yogurt rose by 26%, sliced cooked meats by 17% and cheddar cheese by 24%. And while sandwiches still pack a punch at lunch, featuring in over half of kids’ lunchboxes, they are disappearing from some school bags as options like cooked poultry become more popular.

Packed lunches weren’t the only thing on parents’ shopping lists. While the overall childrenswear market for back-to-school dipped slightly over the summer, grocery retailers grew ahead of the market at 8.4%.** The grocers clearly did their homework on back-to-school fashion. Value is still at the front of shoppers’ minds, and retailers have tapped into this. Average prices have fallen, and buyers have increased their basket sizes as they aim to make the most of the discounts on the table.” Our data shows that families are also turning to the second-hand market in search of deals, with 13.1% of schoolwear shoppers buying it pre-worn.***

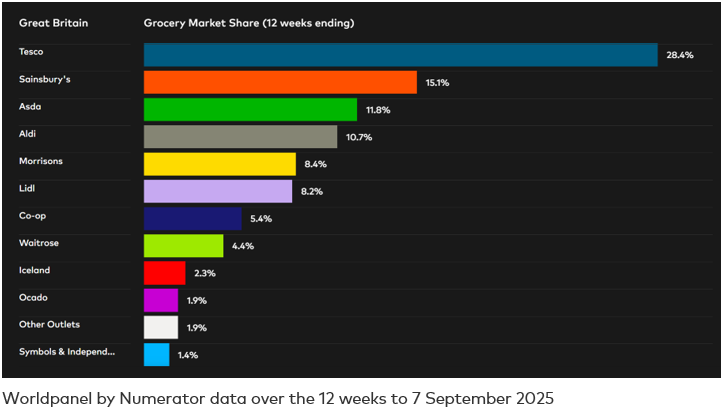

Tesco win most share, Ocado fastest growing

Ocado was once again the fastest growing retailer, with sales rising by 11.9%. It outpaced the wider online market which was up by 8.2% over the 12 weeks. Spending through the tills at Sainsburys increased by 5.4%, taking its portion of the market up to 15.1%.

Lidl was the fastest growing bricks and mortar retailer with sales up 11.0%, moving its share to 8.2% from 7.8% in 2024. Fellow discounter Aldi held its 10.7% share with an uplift in spending of 4.7%. Morrisons' portion of the market is now 8.4%, while Asda’s stands at 11.8%.

Take-home sales at Iceland grew by 4.7% with its share remaining at 2.3%, while convenience specialist Co-op has a 5.4% hold of the market. Waitrose’s share sits at 4.4%, with spending up by 4.3%. Sales of groceries at M&S were 5.9% higher than a year ago.

*Worldpanel by Numerator usage data 4w/e October 2022-2024 under 16 out-of-home carried out lunches vs rest of the year

**Worldpanel by Numerator fashion data for the back-to-school childrenswear market in Great Britain across Asda, Tesco, Sainsbury’s, Morrisons, Lidl and Aldi, sales for the 12 weeks to 17 August 2025.

*** Worldpanel by Numerator PanelVoice Second-hand Survey, 9,200 respondents, Buyer (%), 52 weeks to 20 July 2025