The market for electric vehicles (EVs) has experienced significant growth in recent years, with global spending on passenger EVs reaching $388 billion in 2022 - a 53% increase from the previous year. According to a report by BloombergNEF, EVs are expected to account for 23% of all new car sales worldwide by 2025.

Given the potential of this market, Kantar recently surveyed 4,000 people online across four countries (the US, UK, Germany, and Singapore) using its Profiles Audience Network to examine consumer attitudes towards EVs.

The study explores what motivates consumers to consider buying an EV and what concerns might discourage them from doing so. Additionally, it examines consumer preferences for EVs made by traditional car makers versus those made by specialty EV makers. The research also investigates how much trust consumers place in auto-pilot technology in EVs and their overall sentiments towards future developments in the EV market.

Here are some of our key findings.

Current adoption of EVs in four markets

The majority of car owners in all four markets still primarily drive gasoline cars. The US has the lowest adoption of EVs, with only 3% of car owners driving an EV, while Singapore has the highest adoption, with 10% of its drivers using EVs. The percentage of primary cars in use that are EVs is 5% in both the UK and Germany.

In the US, 87% of car owners still primarily drive gasoline cars, with 6% using hybrid cars, 4% driving diesel cars, and 3% driving EVs. In Germany and the UK, over half of car owners (66% and 56%, respectively) primarily drive gasoline cars, with a higher percentage of people driving diesel cars than in the US (23% and 29% respectively). The market share in Singapore is the most diverse among all markets surveyed, with 53% driving gasoline cars, 19% using hybrid cars, 18% using diesel cars, and 10% driving EVs.

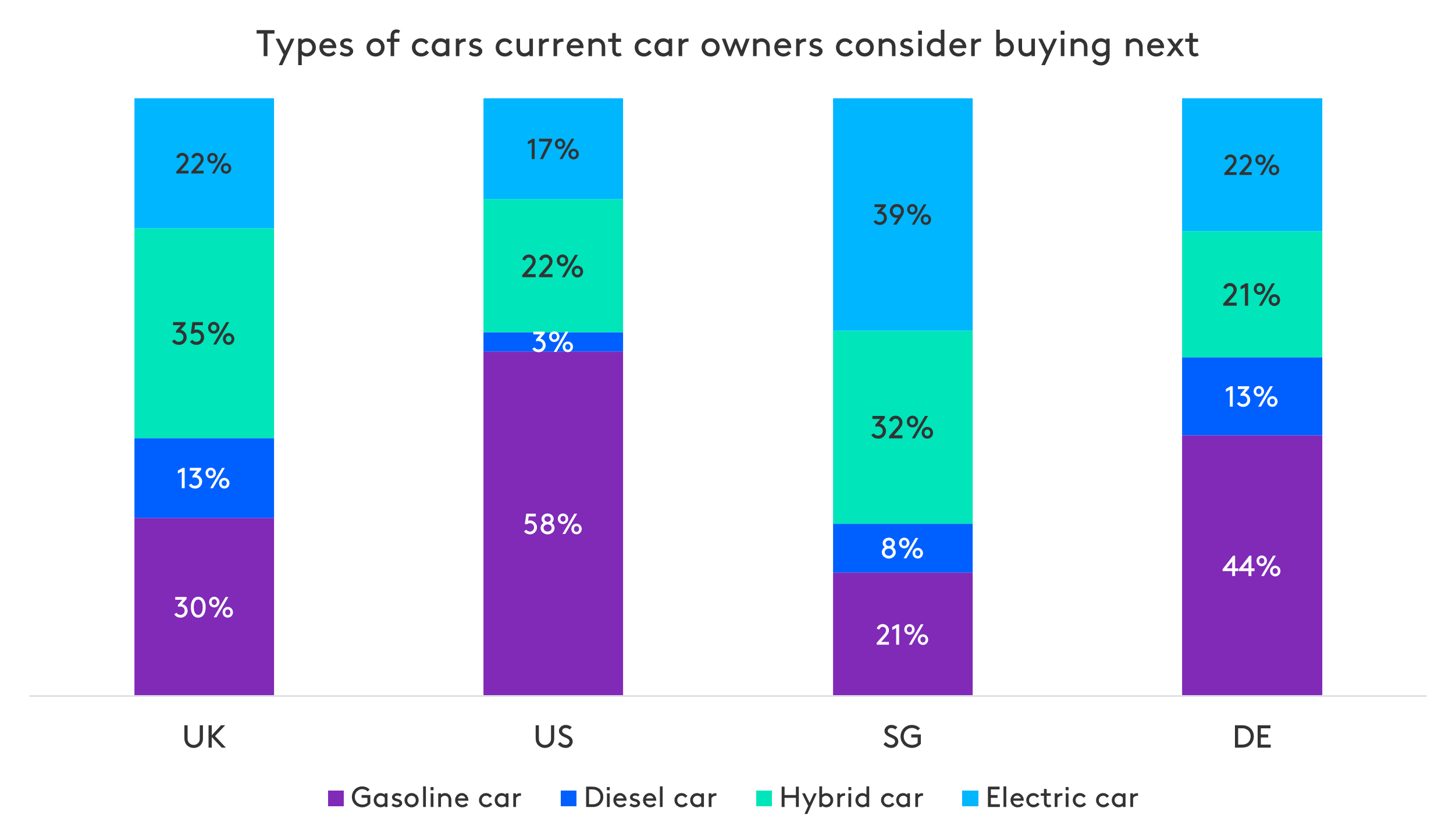

Consumers are considering buying an EV for their next car

When asked about the type of car they would like to buy next, current car owners' preferences varied across different markets. In the US and Germany, the most popular option is still a gasoline car (58% in the US, 44% in Germany). In the US, the second most popular option is a hybrid car (22%), followed by EVs (17%) and diesel cars (3%). In Germany, the second most popular option is an EV (22%), followed by a hybrid car (21%).

Hybrid cars are the preferred option for the next purchase among current car owners in the UK, with 35% considering buying one, the highest percentage among all markets surveyed. The percentage of current car owners who are considering buying an EV next is 22% in both the UK and Germany. EVs are the most popular option for the next car purchase in Singapore, with 39% of car owners selecting EVs and 32% selecting hybrid cars.

Younger people are more likely to consider buying an EV, including those who currently own a car and those who don't. This trend is evident in the UK, the US, and Singapore. Among those who prefer to buy an EV next, 42% in Singapore, 35% in the UK, and 30% in the US are Gen-Z (aged between 18-25). In Germany, unlike the other three markets, boomers account for the majority (27%) of those who are considering an EV for their next car.

Motivators for EV purchase

The primary motivators for current EV owners in the US, UK, and Germany are cost savings on fuel and maintenance, as well as the positive environmental impact. Meanwhile, EV owners in Singapore have different motivators, citing the availability of charging stations (44%), brand reputation (41%), and environmental impact (41%) as their top reasons.

In addition to environmental impact and cost savings on fuel and maintenance, one-third of EV owners in Germany were motivated by government incentives. In the UK, driving performance and range motivated 31% of EV owners. Meanwhile, in the US, one-third of EV owners cited the price of an EV model as a motivator. This reflects the availability of multiple price options of EVs in the market.

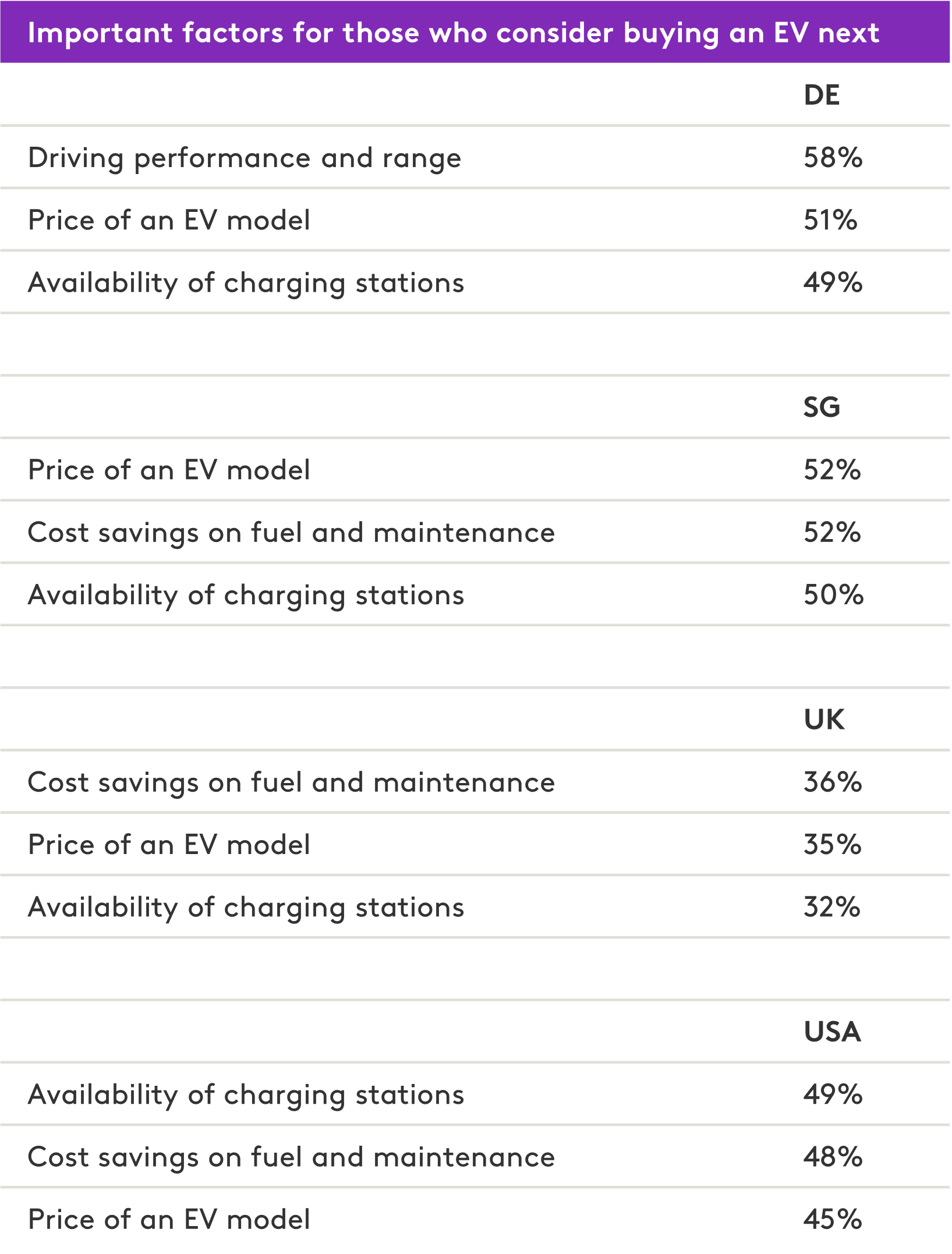

Important factors for those considering buying an EV

As mentioned earlier, the motivators for current EV owners vary across different regions. But what about potential EV buyers? According to the previous chart, 39% of consumers in Singapore see an EV as their top choice for their next car, compared to 22% in the UK and Germany, and 17% in the US.

Interestingly, the priorities of potential EV buyers differ from those of current EV owners. In Germany, for example, almost 60% of potential buyers care about the driving performance and range of an EV. Meanwhile, in Singapore, 52% of prospective buyers take into account the price of an EV model and the potential cost savings on fuel and maintenance. In the UK, the top two factors are similar to those in Singapore, but only 36% of potential buyers cite cost savings on fuel and maintenance, while 35% prioritize the price of an EV model. In contrast, potential buyers in the US are most concerned about the availability of charging stations (49%).

Moreover, there are differences in the preferences of potential EV buyers within the US. For instance, in the Northeast and Midwest regions, the most crucial factor is the availability of charging stations, with 58% of potential buyers in the Northeast and 45% in the Midwest mentioning it. In the South, on the other hand, cost savings on fuel and maintenance matter most, with 53% of prospective buyers indicating this factor. In the West, the primary concern of consumers is the price of an EV model, with 53% of potential buyers prioritizing it.

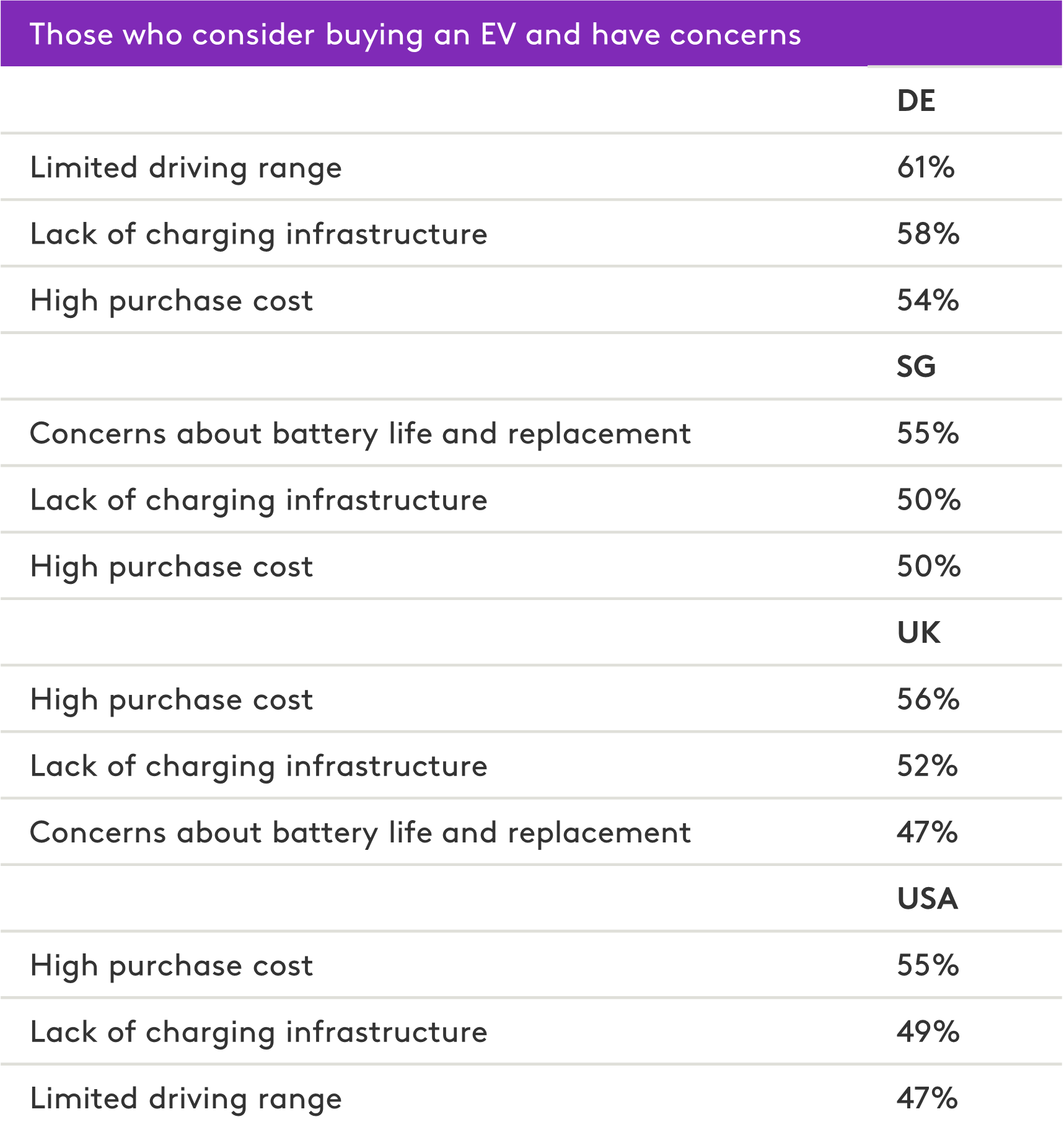

Barriers to EV adoption: range anxiety and costs

Although a significant percentage of consumers in the four selected markets are considering buying an EV as their next car, they also have concerns about EVs, with over 60% of potential buyers expressing such concerns. The top three concerns that discourage most buyers from purchasing an EV include "limited driving range," "lack of charging infrastructure," and "high purchase cost."

In Germany, the main concern among potential EV buyers is the "limited driving range" (61%), which is also known as "range anxiety." The second biggest concern is the "lack of charging infrastructure" (58%). In Singapore, potential buyers are more worried about "battery life and replacement" (55%). On the other hand, in both the UK (56%) and the US (55%), the high purchase cost of an EV is the biggest barrier for most buyers.

EVs are facing competition with hybrid cars

Although the EV market is growing, it faces competition from other options available to consumers. As mentioned earlier, 21-35% of car owners in the four surveyed markets prioritize the possibility of buying a hybrid car next to an EV. In fact, 35% in Singapore and 33% in the UK prefer a hybrid car over an EV for their next purchase.

The top reason cited by those who prefer a hybrid car over an EV for their next car is the "lack of charging infrastructure for EVs." This reason is most common among respondents in Germany (54%), followed by those in the UK (48%), Singapore (45%), and the US (43%). The second most common reason for choosing a hybrid over an EV is the high cost of an EV, which ranges from 36% to 41% among those who choose a hybrid over an EV in the four markets.

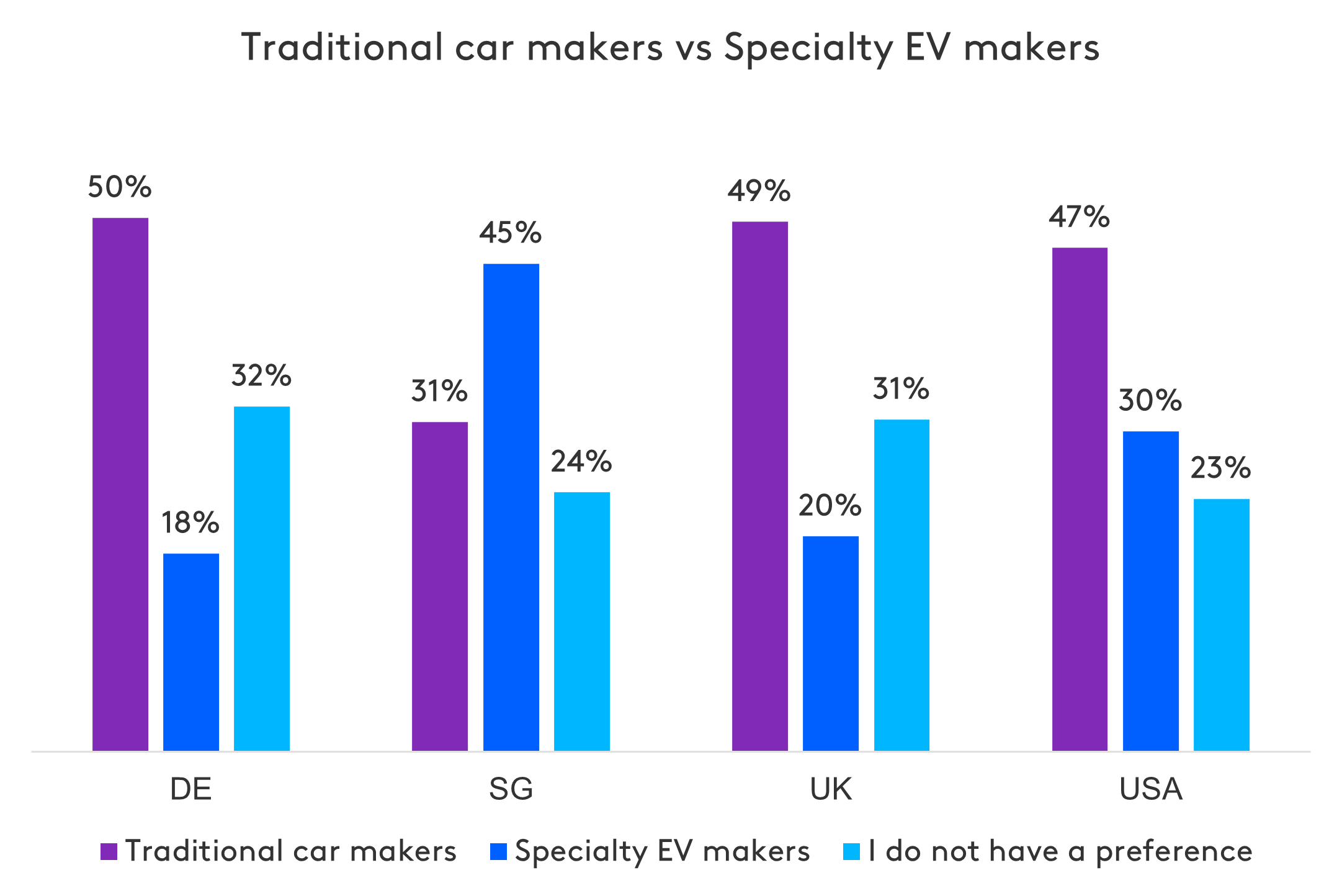

Traditional car makers vs. specialty EV makers

Consumers have more options than ever when it comes to choosing an electric vehicle (EV), not only in terms of different car types but also different EV makers. Traditional car makers such as Ford and BMW have recently released new EV car models to compete with specialty EV makers like Tesla. When asked which type of EV maker they prefer, nearly half of potential EV buyers in the US, UK, and Germany prefer traditional car manufacturers, while those in Singapore tend to lean towards specialty EV makers (45%).

Consumer budget may play a role in the preference for traditional car makers versus specialty EV makers. In the UK and the US, those who are able to easily meet their daily budget are more likely to prefer buying an EV from traditional car makers. For example, 52% of those in good financial standing in the US prefer traditional car makers, compared to 26% who prefer specialty EV makers. On the other hand, of those who find it difficult to meet their daily budget in the US, 34% prefer specialty EV makers, which is 8% higher than those who can easily meet their budget.

For more information on the reasons behind these preferences, reach out to Kantar.

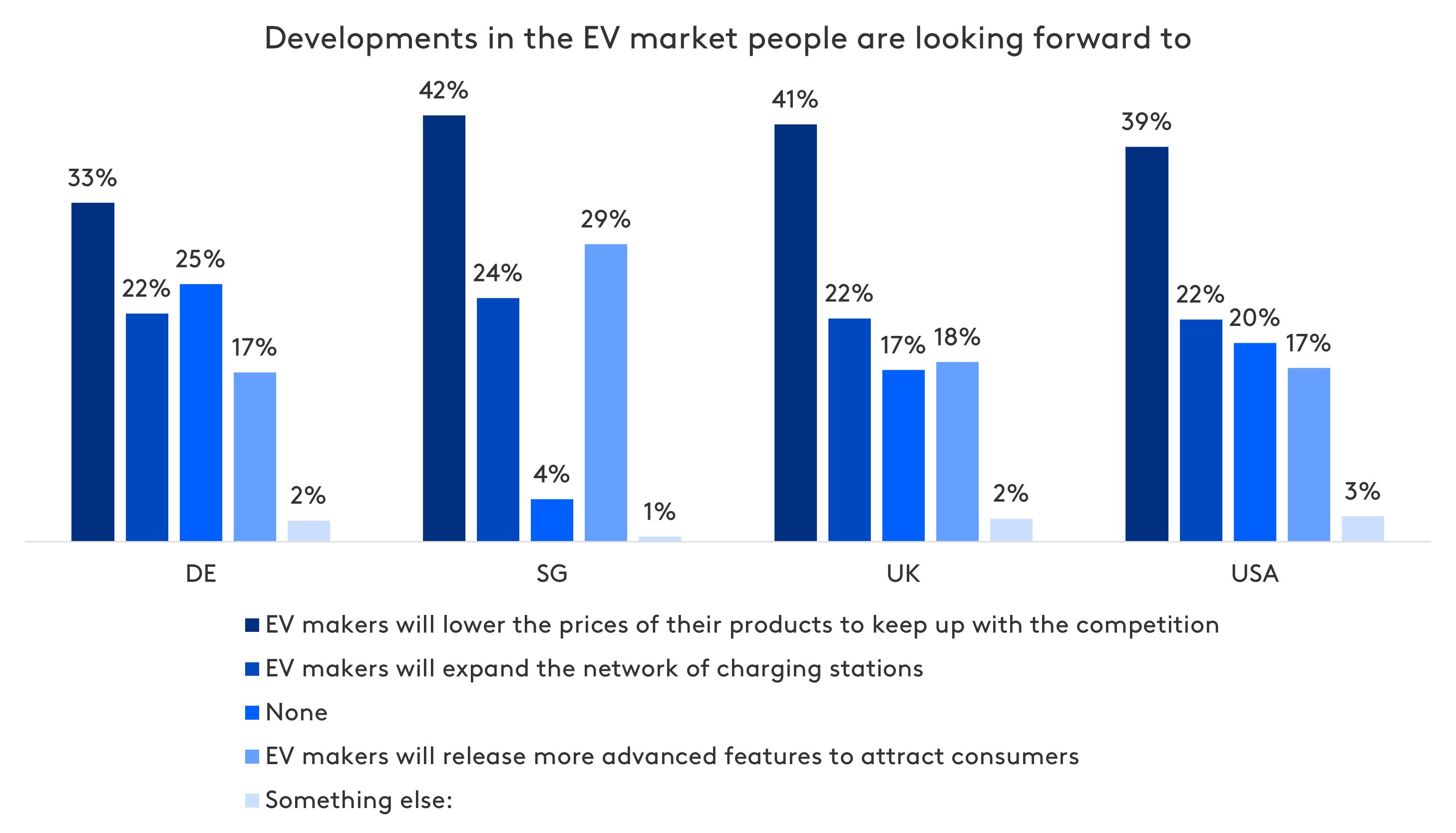

Consumer sentiments toward the future of EVs

EV adoption is expected to increase globally, and the market is evolving based on organic consumer demand. We specifically asked consumers about their opinions on one aspect of EVs, namely the autopilot system. We found that over 60% of people in the US (69%), UK (60%), and Singapore (67%) are familiar with auto-pilot technology in EVs, whereas only 39% in Germany are.

In the US and UK, half of the population expressed some level of trust in auto-pilot technology in an EV to make safe and reliable driving decisions. In Germany, 55% of people trust it to some extent. Singapore has the highest level of trust in autonomous driving systems of EVs, with 73% saying they trust the technology to some extent.

Consumers are generally optimistic about the future of the EV market. In addition to infrastructure and advanced features, consumers are most interested in a price reduction of EVs in the next two years, which highlights price as a key motivator.

About this study

This research was conducted online among 4,000 people across three countries: US, UK, Germany, and Singapore based on local age and gender census distributions. Respondents were sourced from the Kantar Profiles Audience Network and powered by Accelerated Answers. All interviews were conducted as online self-completion between 3 and 10 April 2023.

Subscribe to get more insights like this

Have the latest consumer insights powered by Kantar Profiles Audience Network and business updates from the Profiles division delivered to your inbox. Sign up using the form below to stay informed.