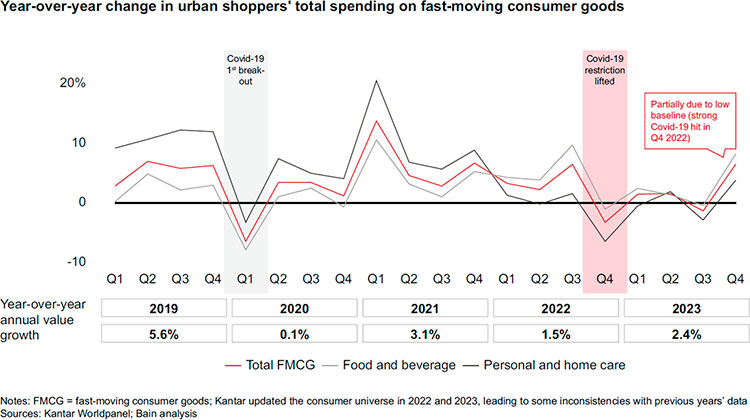

Moderate recovery was the standout trend in Mainland China’s FMCG sector through 2023 and into the first quarter of 2024, according to the 27th China Shopper Report [2024 Vol. 1] released by Kantar Worldpanel and Bain & Company.

The take-home grocery market grew 2.4% in 2023, lagging GDP growth (5.2%) and total retail market growth (7.2%), due in part to the recovery of out-of-home (OOH) consumption post pandemic. Volume continued to be the main driver, with an increase of 2.4%, while average selling prices (ASP) remained relatively stable throughout the year. Despite this, we still observed premiumisation in some categories.

In the first quarter of this year, China’s FMCG sector grew around 2% in value, half a percent higher than Q1 of 2023, supported by a 3.5% increase in volume. This indicates a continued strong desire for consumption. However, there was a deflation of 1.5% in ASP, in contrast with the stable pricing trend observed in 2023.

Geographically, FMCG growth in 2023 was led by Tier 2 cities. These have received a population influx of more than 8 million in the past four years, and have become must-win markets for most FMCG brands.

Packaged food and beverages lead growth

Packaged food and beverages grew 2.7% and 4.3% in Q1, respectively, compared to the same period last year. Most categories within packaged food experienced volume growth due to consumers’ increased social mobility. Beverage growth was driven by both volume and ASP, particularly in juice, ready-to-drink tea, and packaged water.

Most home care categories saw strong volume demand driven by leading players’ efforts to promote diverse use occasions, leverage increased social activities, and establish focus on hygiene and health post-COVID. However, in contrast with the price premiumisation recorded in 2023, there was a price deflation in Q1 2024, driven by brands’ price cuts and promotion of larger, bulk-sized products.

Similarly, personal care witnessed robust volume growth, but ASP declined 7.5% as consumers remained cost-conscious, and most categories faced competition from domestic brands offering more value-for-money products.

Offline channels regained momentum

Overall, offline channels grew by 2.4% in Q1 2024, slightly higher than the overall FMCG and ecommerce channels, due to recovering footfall. Grocery and super/mini formats continued to gain share, growing 11% and 7% respectively compared to the same quarter last year. Hypermarkets continued to shrink a 6%; however club warehouses saw notable growth of 22%, and now represent a 9% share of the total hypermarket segment.

Growth in ecommerce was low at around 2%. Douyin surpassed JD to become the second-largest platform in China, delivering substantial growth of 46% and achieving an 18% market share in Q1 2024, 6% higher than Q1 2023. Pinduoduo increased traffic through its value-for-money proposition, resulting in 6% growth and a 15% market share, 1% higher than last year. JD grew 5% as a result of its low-price strategy, reversing last year’s 1% decline. Still leading the pack, Taobao/Tmall continued to decline, with a market share of 32%, 3% lower than in Q1 2023.

For more insights and recommendations, download the China Shopper Report [2024 Vol. 1] via the form below, or contact our experts.