If you want to look for growth markets then Latin America is a serious contender. Last year consumers not only invested more in home purchases than ever before but also increased spending at a rate higher than the global average and local market inflation.

The figures from Worldpanel’s Brand Footprint Latam 2024 reveal to a 14.3% increase in fast-moving consumer goods spend compared to a rise of 8% worldwide.

Each household spent an average of $928, a 12.8% increase, while expenditure per shopping trip increased by 12.4%, almost double the global growth rate of 6.7%. Spend grew 10 times faster than the population.

The findings are based on analysis of purchase decisions made by Latin American customers, covering 14 markets, reflecting the habits of 90% of the regional population: Central America (Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua, and Panama), Argentina, Bolivia, Brazil, Chile, Colombia, Ecuador, Mexico, and Peru.

More choices and more competition

The purchase boom of 2023 means that Latin Americans made 53 billion choices during the year, an additional 10.3 million choices or a 1.7% increase compared to the previous year.

Consumers are choosing at least one brand every day, with a repertoire of nearly 90 brands in the average household each year. That’s significantly higher than the global average of 62.3 brands.

Food accounted for more than a third (35.7%) of all brand choices, followed by Beverages (22.1%) and Home Care (15%), with local and regional companies capturing 62% of the market. More than half the brands (53%) in our Top 250 grew their total shopper numbers.

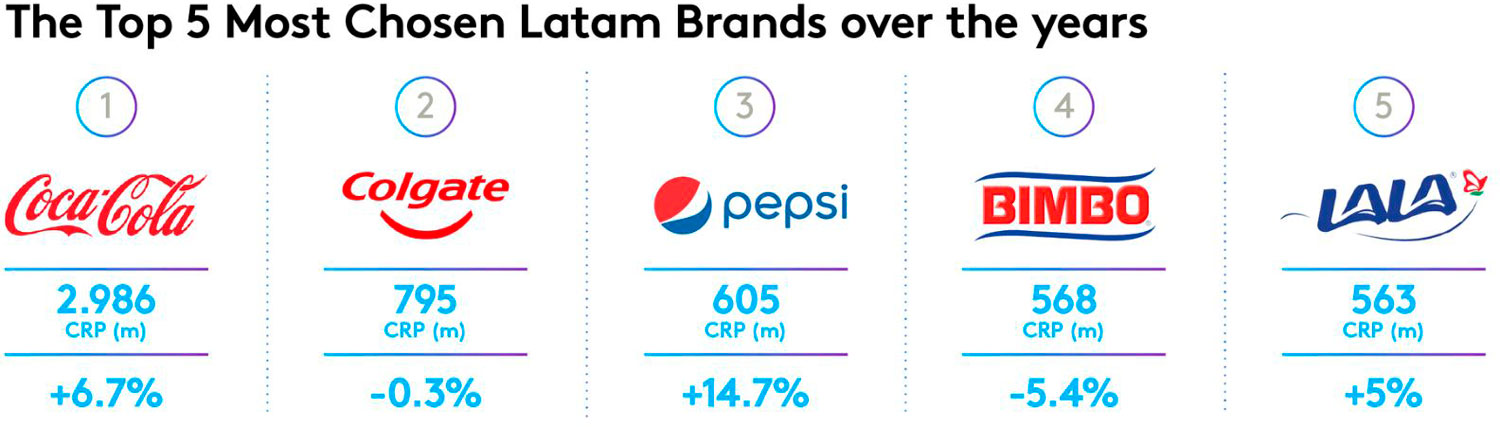

The most purchased brands in Latin America, ranked by Consumer Reach Points (CRPs) measuring how many households purchase a company's products and how often this happens, are:

Frequency matters most in 2023

Sources of growth differ and while penetration remains an important factor in this region, it’s not as important as it was last year. While penetration builds the foundation, frequency — how often consumers purchase a brand — amplifies the impact. Increasing frequency ensures that once a consumer is brought into the fold, they are engaged and retained.

For smaller brands, a third of the growth will primarily come from new buyers; for Super Brands, getting more customers to buy one more product one more time brings in the big numbers.

This is reflected in the unique growth profile for Super Brands in 2023, where penetration alone accounted for just 10% of their growth in Latam but frequency played a role in nine out of 10 CRP rises.

That compares with Medium brands – those with a 10-30% penetration – which found 36% of their growth via penetration. The simple truth is that the bigger you are, the more frequency is critical, while down the scale, penetration is a more powerful weapon.

However, what we also see is a dramatic shift for all sizes of brands to frequency. In 2023, both penetration and frequency, and frequency alone rose for every size of brand. Even among Small brands the percentage of growth that comes from penetration and frequency has risen by nine points to 55% with frequency alone up from 7% to 12%.

What to do now

The Brand Footprint report for Latam highlights key areas where brands can make a difference and ensure they continue to thrive.

- Set realistic targets

- Move frequency up the agenda

- Consider the impact of market polarisation

- Reflect on consumption occasions

- There is room to grow

To learn more about these pointers to brand success, and to truly understand how Latin America’s choices are changing and what’s driving what they are buying and where they are buying it, read the full report here.