With a cost-of-living crisis potentially looming for millions of people around the world, and inflation rates of some countries top 10%, there are signs of music subscribers cutting back on their subscriptions. But how heavily is this going to affect the different platforms in the Music on Demand (MoD) market?

Q1 2022 key take outs:

- Over 1 million music subscriptions have been cancelled in the last quarter in GB, with wanting to save money being cited by 37% of consumers as the reason they cancelled.

- Value for money is still the #1 driver of new subscriptions in 3 of our 4 survey regions, with only Germany having a different leading reason (music platforms my friends use)

- The number of new music subscribers dropped to below 1% of the population in GB in Q1 of 2022, with the US and Germany also seeing a drop in new subscribers compared to the last year.

- In GB, subscriptions are dropping the quickest amongst younger consumers; the percentage of under 35 having access to a music subscription having dropped from 57.0% to 53.5% year on year.

Cost-of-living crisis causing cancellations

With inflation rising to 9% in the United Kingdom and further rises in the cost of living expected, the rising cancellation rates of music subscriptions is evidence that British households are starting to prioritise the spending of their disposable income. Over 1 million subscriptions were cancelled in the last quarter, which has also seen the highest level of consumers citing they want to save money as the reason they want to cancel their subscription, at 37%. This number is up 4% from the same period last year.

|

|

Q4 2021 |

Q1 2022 |

Q1 2022 |

|

GB |

39.7 |

39.5 |

3.0 |

|

US |

48.8 |

48.8 |

4.6 |

|

Germany |

35.9 |

36.6 |

5.1 |

|

Australia |

- |

48.6 |

- |

Younger streamers cutting back?

These factors have created a small drop in penetration of total individuals who have access to at least one music subscription, now 39.5% of GB adults. This is much lower than the peak at the start of 2020 at 43.6%. One of the reasons for this drop in penetration is due to a decline in the number of young people with subscriptions. 600k fewer under 35s have access to a music subscription compared to the previous year, with the penetration of students who have access dropping from 67% to 59%. Some of the main reasons under 35s are planning to cancel and are over-indexing in compared to the over 35 group include not a wide enough selection of music, too many advertisements or having technical difficulties.

The US has seen a sharper decline of almost 5 million people under the age of 35 no longer having access to a music subscription service, dropping from 69% to 63%. With three of the top 5 reasons in all territories linking back to money saving, this could show that consumers around the world are looking to cut down on their expenses during this cost-of-living crisis. However, the other issues highlighted show areas platforms can focus on to help retain younger users.

Amazon’s unwelcome price hike in May

In GB the price of some Amazon Music Unlimited subscriptions is rising this May. The Single-Device and Individual Plans are both rising by £1/$1 per month, with the latter’s annual price seeing a rise from £/$79 to £/$89 per year. With 7.1% of current Amazon Music Unlimited subscribers in GB, US and Germany already planning to cancel their subscription, rising prices could lead to an increased number of cancellations over the next few months across all the global markets.

When examining the reasons that consumers are planning to cancel their music subscription in the upcoming quarter, the number one reason is that they plan to save money, with 37% of Amazon Music Unlimited planned cancellations in GB citing this as one of the key reasons. This is above the market average, with only Spotify having a higher percentage of cancellations citing this reason at 41%.

Spotify brush off Rogan criticism

After Neil Young was one of a group of musicians who removed their music libraries due to the platforms continued support of the Joe Rogan Experience podcast, Spotify have not suffered many ill-effects in the latest quarter. In Q1 2022 Spotify saw their share of new subscribers increase compared to last quarter, rising to 22%. The percentage of new subscribers who have been driven to sign up by the variety of artists available on Spotify has also increased from last quarter and compared to the start of the previous year, rising to 35.5%. The variety of artists available is one of the top three reasons that subscribers sign up to Spotify, sitting 1st in the US (31.5%), 2nd in GB and 3rd in Australia (33.2%) and Germany (27.7%). This highlights the importance of the artists available on Spotify globally but shows that a platform losing a handful of artists will not affect a new subscriber’s hunger to sign up.

In contrast, an area that Spotify have suffered in over the last three months has been the satisfaction of their current subscribers. Spotify’s record of having the highest Net Promoter Score since our records began in the GB is under threat, with their score of 33 is the lowest the platform has recorded since Q1 2020. When looking from a global standpoint, Spotify’s NPS index vs average has decreased in GB, US and German markets compared to the last quarter, suggesting competitors are stepping up the quality of their service.

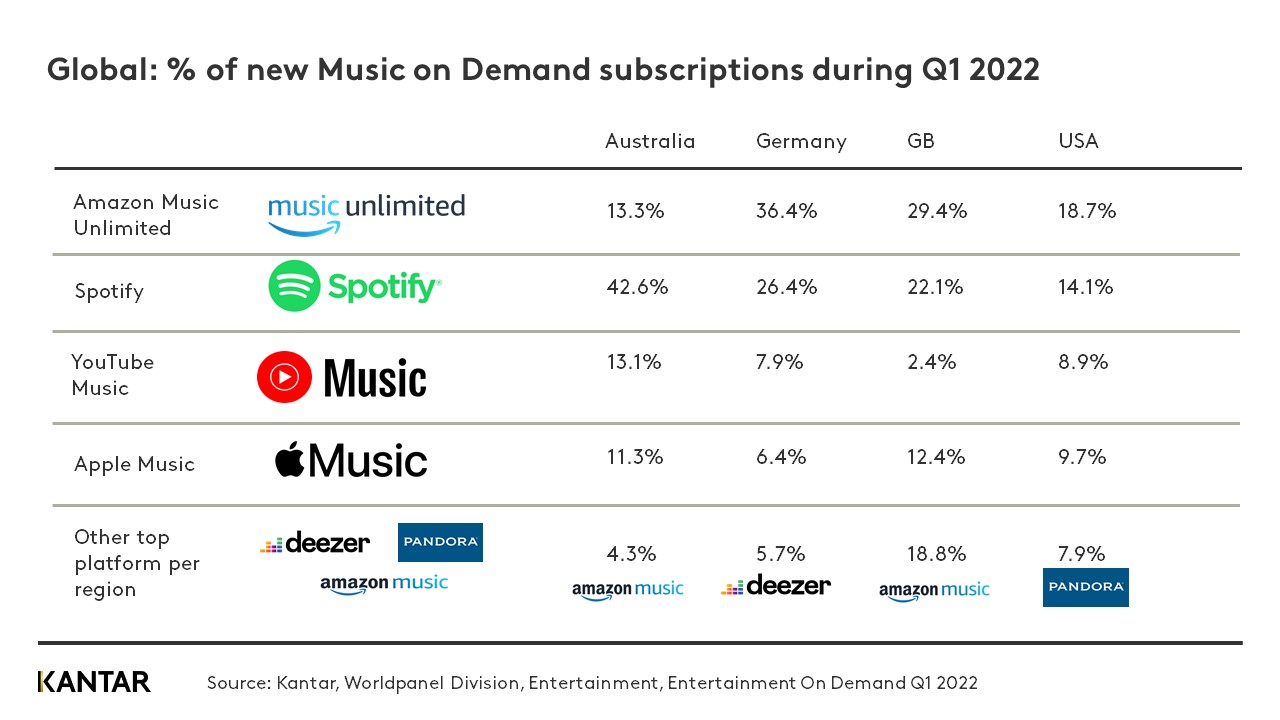

Welcome Australia!

In Q1 of 2022 Kantar’s Entertainment on Demand service expanded to Australia, allowing us to provide longitudinal insights across the video and music streaming sectors. The initial numbers show that 49% of Australians subscribe to at least one music streaming service, amounting to 9.92 million individuals. This number is similar to the US, and larger than GB and Germany’s. The market is dominated by Spotify, with 74% of MoD consumers using the platform, with Amazon Music Unlimited and Apple Music rounding out the top three. A similar trend is also seen for new subscribers, with almost half of them in Q1 2022 going to Spotify (43%), with the next highest being Amazon Prime Unlimited (13%). With a new territory being added to the Entertainment on Demand service, it will be exciting to see the long-term trends that come out of Australia’s music streaming market over the coming years.

If you would like to learn more about our Music on Demand services, please reach out to our experts.