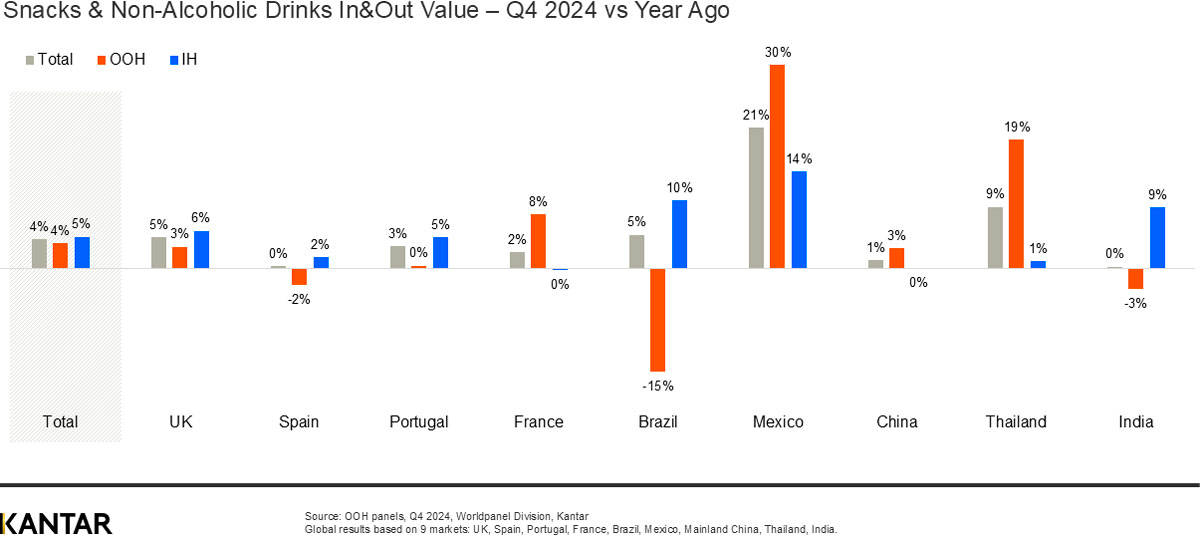

Following several consecutive quarters of post-COVID recovery, 2024 saw a steady slowdown in the growth of the global out-of-home (OOH) snacks and non-alcoholic drinks market. Value growth of 17% in Q4 of 2023 steadily declined to 4% in Q4 of 2024, compared with a much shallower drop from 7% to 5% for products purchased to consume in-home, which can be attributed to an ease in price inflation.

This trend is putting pressure on the overall global snacks and beverages market, with total value growth decelerating from 10% to 4% over the year.

The slowdown is particularly evident in the UK, Spain, and Portugal. In fact, in-home is winning over OOH in all markets measured by Kantar except France, Mexico, China and Thailand.

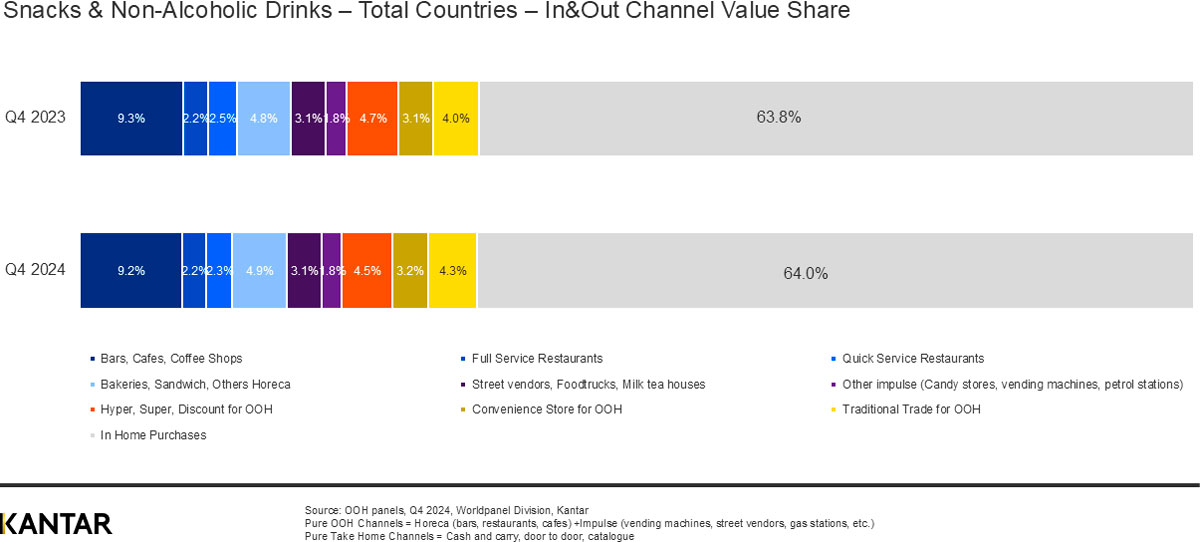

As a result, the OOH share of total spend on snacks and beverages remains stuck at 36% – dropping slightly from 36.2% one year ago – resulting in a slight rebound from 63.8% to 64% for in-home purchases. This is the first time in 14 quarters (since summer 2021) that OOH growth has fallen below in-home growth, and stops short of the 60/40 split seen before the pandemic hit.

Consumers make fewer OOH trips

The catalyst for the slowdown in OOH revenue is a deceleration in the growth of trip frequency, rather than lower price per unit. Nor are consumers reducing their purchase frequency across the snacks and drinks sector overall: they are actually shifting their trips across to in-home purchases.

In Q4 of 2023, an increase in trips contributed 82% to the rise in OOH value, but just 25% in the final quarter of 2024. On the other hand, trips were responsible for 57% of the in-home value growth in Q4 2023, a figure which continues at around 60% a year down the line.

Growth stalls in bars, cafes and coffee shops

Turning our focus to OOH channels, the pace of value growth in coffee shops, quick service restaurants (QSR) and modern trade channels has been most affected by the changes in consumer behaviour. However, impulse and traditional channels are continuing to offer growth opportunities, as the ‘on the go’ eating and drinking habit remains a positive trend.

Non-alcoholic drinks drive the in-home evolution

The growth rate for beverages is slower in OOH across all categories – coffee, juice, soft drinks and water – with a 4% year-on-year rise in in-home spend, compared with a 3% lift for OOH. For snacking food, growth in spend is the same for both in- and out-of-home occasions at 5%.

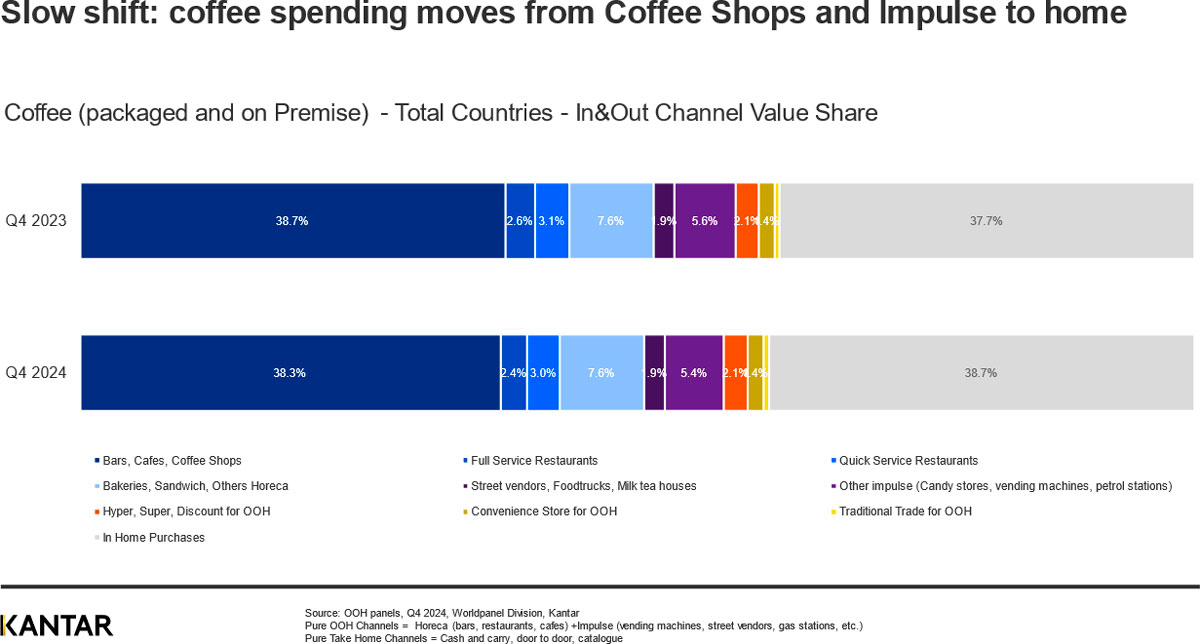

Despite the slowdown, it’s important to acknowledge that many categories are still growing OOH, with biscuits (8%), coffee (4%) and packaged water (4%) the fastest risers in Q4 of 2024. Zooming in for a closer look at the coffee category, however, reveals that consumption is gradually becoming more of an in-home habit.

Spend on coffee to drink at home has grown 9% year-on-year – 5% higher than OOH – while the in-home share of total spend on packaged and on-premise coffee has risen a small but significant 1% from 37.7% to 38.7%.

This could be due to a downtrading trend, with consumers deciding to socialise and treat themselves at home instead of going out, purchasing high quality packaged coffee that enables them to recreate the ‘café experience’ in a more affordable way.

In terms of channels, bars, cafes, coffee shops and restaurants are being impacted the most by this emerging habit. Currently, the spend in coffee shops and on purchases to consume at home are very similar, both at around 40%. The remainder of coffee-lovers’ budgets are being spent in impulse and other channels.

Detailed analysis of two key markets – the UK and Spain – shows that branded coffee shops, those that are part of a major chain, are losing value share to independent cafés. This is due to bigger price increases, which averaged out at 11% in the UK and 13% in Spain over 2024: four to six times higher than the rises implemented by independents.

In the UK, where branded coffee shops are extremely popular, people switching to independents instead has boosted their share by 8.5% to reach 70% of total spend. In Spain the split is even more marked, with independents (+1.4%) now holding 95% of the market.

Spotlight on Thailand

It’s worth stopping to remember that there are two contrasting realities within the global OOH snacks and drinks sector. While some markets are struggling to maintain growth momentum, others are bucking the trend. Thailand is one of those.

Growth in Thailand’s OOH FMCG market was significant in 2024, with value sales rising by a healthy 19% year-on-year. This was driven by Thai consumers’ expanding purchasing power, along with a desire for convenience amidst their increasingly fast-paced lifestyles. They are willing to open their wallets wider, and to try new things.

As a result, OOH consumption is growing across all categories – in particular loose pack products, freshly brewed beverages, and ready-to-eat food, including street food. Packaged products have also grown, especially in RTD (ready-to-drink) beverages.

Thailand’s example highlights that the growth in spend on snacks and non-alcoholic beverages could reignite, and accelerate once again. Things can change very quickly in FMCG. Brands that target consumers when they’re out and about need to keep a very close eye on changes in behaviour and demands, if they are to protect and sustain their hard won post-pandemic recovery.