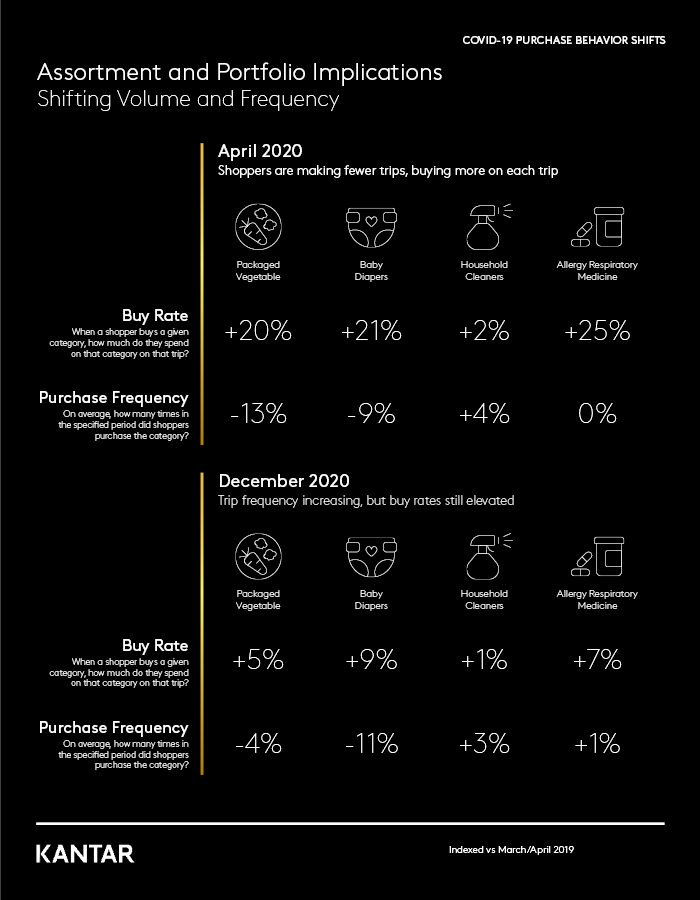

When we first ran this study back in April 2020, we saw massive swings caused by changes in consumer sentiment and shopper behavior. People were shopping differently at the start of the pandemic: volume and frequency were shifting as shoppers made fewer trips but purchased more in each of those trips.

Now almost one year later, we see softening of these early-pandemic trends. Trip frequency is increasing, but still below where it was pre-COVID. Similarly, stock-up levels are lower than in April, but shoppers are still purchasing more per-trip. Though not as extreme as the trends that we saw in early COVID days, the “new normal” in COVID-era shopping may remain as fewer shopping trips with higher buy rate per

What does this mean for brands and retailers? Continued elevation of buy rates means that inventory and supply chain remain crucial. Ensure you have the right assortment, content, and strategy for lasting online grocery behaviors. As vaccine roll-out becomes more widespread in Q2, continue to re-evaluate what behaviors will be sustained post-pandemic.

As we continue to weather the storm and prepare for a gradual return to a new normal, our white paper shows why brands and retailers must respond to swings in shopper behaviour and demand shifts. The brands and retailers that will win are those that can make quick optimisations in the near term while maintaining a level head for long-term planning and preparation.

Download the whitepaper via the form below or contact our experts to start planning your future assortment strategy.