When Kevin Systrom and Mike Krieger decided to refocus their nascent app on photo-sharing, they tapped into a longstanding motivation: the desire to share experiences with others. By providing an easy way to instantly enhance and share mobile photos, Instagram opened the floodgates to a tsunami of content, ranging from the sublime to the banal.

Adoption of the new app was rapid, gaining 100,000 users in the first week and more than a million downloads in its first two months. Today, thanks to its commitment to continual innovation, Instagram offers a multitude of ways to share photos and videos and boasts two billion monthly active users worldwide.

Instagram's rapid growth and its mobile-first platform made it a hot commodity early on, despite its lack of revenue. Just two years after its first release, Facebook (now Meta) bought the growing app for a staggering $1 billion. Many at the time dismissed this as a mistake and a flop. How wrong they were. Today, the Kantar BrandZ Global Top 100 ranking finds the Instagram brand to be worth nearly $114 billion, up a whopping 93% from 2023.

The star of online networking

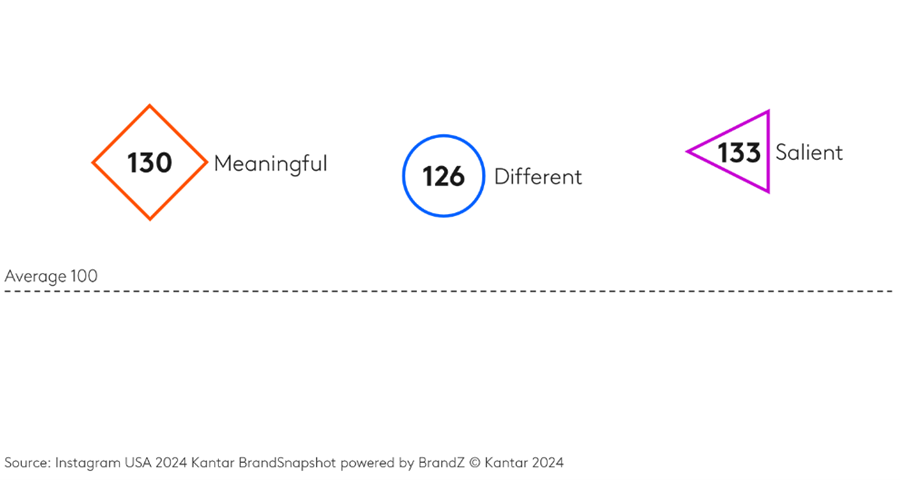

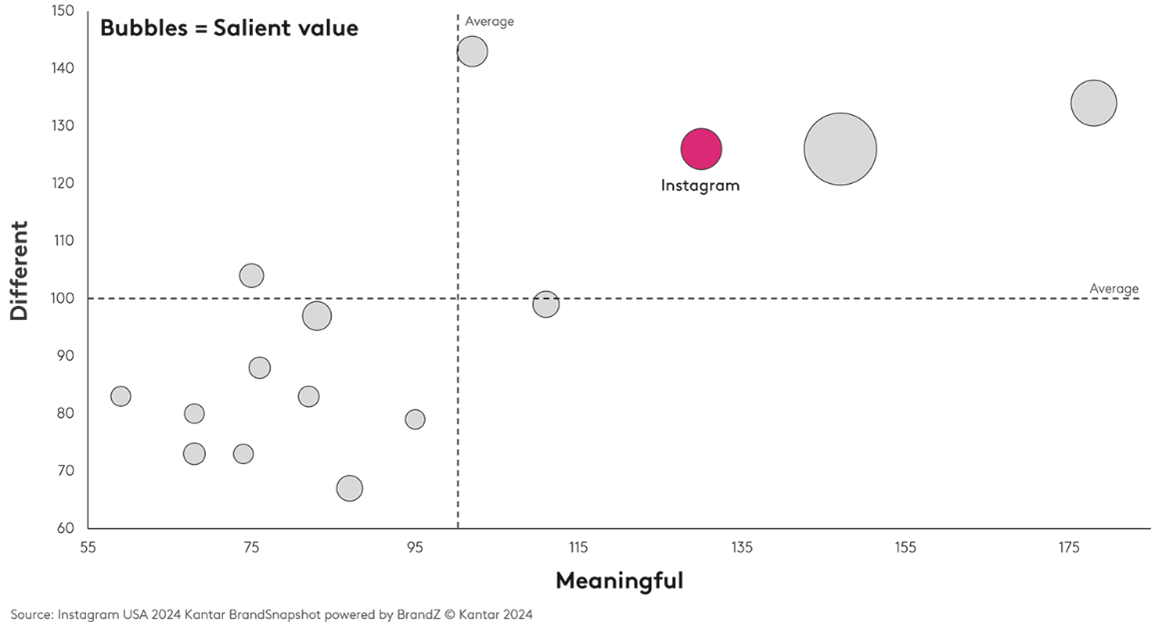

So, what makes Instagram such a strong and valuable brand? To find out, we looked at data from Kantar BrandSnapshot, a free tool on Kantar Marketplace that provides instant access to topline brand performance data on a wide variety of brands. BrandSnapshot classifies Instagram as a Star in the US, a well-known brand that consumers appreciate. Instagram is perceived as more Meaningful, Different and Salient than the average for online network brands, placing it in the same quadrant as its older and bigger sibling, Facebook, and the longstanding YouTube.

Digging deeper into why Instagram is meaningfully different to so many people, we find that the brand’s defining characteristics include its connection with like-minded individuals, everyday usage occasions, and user-friendly interface. These attributes are crucial for a social media app seeking to appeal to a mass audience. While brands like Discord, Snapchat, and even TikTok may offer greater differentiation, they lack the same level of universal appeal.

In retrospect, the acquisition of Instagram has proved hugely important to Meta. Initially, it helped fend off competition from Google+ and Twitter (now X). Later, it provided an avenue to attract a younger audience as Facebook’s user base matured, and now it’s instrumental in addressing competition from TikTok. Monetisation of the brand’s user base through increased advertising sales has contributed to Meta’s share price riding at an all-time high in 2024, with Instagram accounting for almost 44% of total revenue.

Future Power: Instagram vs TikTok

Will Instagram continue to grow its value? BrandSnapshot assesses a brand’s future growth potential based on consumer attitudes called Future Power. From a consumer perspective, Instagram is not as buzzy as brands like Discord and Twitch with slightly above-average Future Power. However, TikTok lags marginally behind Instagram in terms of its potential for growth in the US.

Given the media excitement around TikTok’s future in the US, this finding may initially seem surprising. Still, it suggests that the introduction of Reels was critical in blunting TikTok’s appeal to Instagram’s existing user base. In a recent earnings call, Meta reported that Reels now accounts for 50% of the time spent on the Instagram app. Similarly, the launch of Threads, which capitalised on the chaos surrounding Elon Musk’s acquisition and rebranding of Twitter, has added an important new feature for Instagram users.

Considering Instagram’s current brand strength, the data suggests it is well-positioned for further growth. Two consumer-driven factors that will play a pivotal role in achieving this growth:

- Continued innovation is necessary to ensure that users continue to find the app meaningfully different from its alternatives. Ideally, innovation should manifest as new, unique features that add to Instagram’s appeal rather than merely replicating those of new competitors.

- Meta needs to balance the increasing number of ads with people’s desire to spend time on the platform. Many people report discontent with the amount of advertising on social media, and display behaviour to match. At some point, an increasing ad volume could reach a tipping point for users, spurring them to seek a less disruptive experience elsewhere.

Read more about the Kantar BrandZ Most Valuable Global Brands in the latest report, available at www.kantar.com/campaigns/brandz/global.

Kantar BrandSnapshot is a free interactive tool powered by BrandZ’s wealth of data and its Meaningful Different and Salient framework. Designed to give you a complete picture of brand equity in competitive context, BrandSnapshot delivers intelligence on over 14,000 brands in 40+ markets, offering a quick read on brands performance in a category. Explore for free on Kantar Marketplace today.