This year, Amazon finds itself as the 4th most valuable brand globally according to the Kantar BrandZ Top 100 Most Valuable Brands report. With a brand value of $468,737 million in 2023, Amazon continues to dominate business technology and service platforms, with Amazon Web Services (AWS) remaining number two in this category, and Amazon as a retailer retaining the number one slot amongst all retailers globally.

Retail focus

Amazon continues to evolve its product offerings, aiding its ability to be Meaningful, Different and Salient and see continued strength in the marketplace year after year. Evolving its bundle, or cross-category offer, continues to be a successful playbook for Amazon as a retailer. It improved its equity perceptions in the US this year, largely caused by an upswing in Difference, now in 2023 being seen as more sustainable, ‘superior’, and trusted. Overseas, the picture is more variable; in Japan, for instance, local competitor Rakuten is making a strong effort to regain its Difference edge.

Although Amazon has had to scale back its workforce this year and cut costs after consumers’ demand for online shopping shrank, salience remains high with membership programs like Amazon Prime, which expands its ability to be top of mind across entertainment and retail. However, it is not the runaway winner it used to be and will continue to have competition biting at its heels, as Costco and Walmart+ seek to utilize the membership model to their advantage.

The 2023 Amazon Prime Day showed us that Amazon is again using the two-day event to push deals across its product and service ecosystem. Deals on both major national brands and a variety of challenger brands were prominent this year, as were the standard deals on Amazon-owned devices. Core to Amazon’s strategy is building its full ecosystem, and that is evident in Prime Day grocery and Prime Video deals, credit card promotions, and pushes for Amazon Business. New this year were deals for Amazon’s Climate Pledge friendly products to cement the retailer’s sustainability initiatives, seen especially in the US, France, and the UK.

As part of their differentiation efforts, Amazon has increased selection in the U.S. Amazon store. Amazon added new beauty and fashion brands, including D’Amelio Footwear, Dyson hair care, IT Cosmetics, Ralph Lauren Fragrances, and Urban Decay, and extended its collaboration with Victoria’s Secret. This marks the first time Victoria’s Secret lingerie and apparel are available through a retail partner in North America. Amazon also expanded its selection of grocery items from brands such as General Mills and Coca-Cola. They also announced Amazon Day deliveries, which give Prime members the ability to choose a designated day of the week that makes sense for them to receive their orders, saved 136 million boxes in 2022. On top of making deliveries work for customers’ personal schedules, this free Prime benefit uses 30% fewer boxes on average.

Amazon recently announced it was adding RxPass to its pharmacy footprint, giving Amazon Prime Members access to many generic drugs with free at-home delivery for a flat fee. While there are limitations that need to be resolved, Amazon is also working to implement HIPAA-compliant methods for Alexa to transmit and receive protected health information, so that Alexa can offer general health and wellness skills from developers.

Amazon as an ad platform

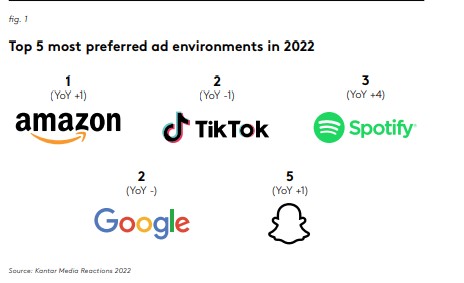

Why is Amazon so successful, not only as an ecommerce and streaming brand, but also as an advertising platform? Amazon’s advertising is seen as the most relevant and useful globally. Amazon has also increased the perception of trustworthiness of ads on its platform, having addressed concerns around excessive and unhelpful ‘targeting’ compared to previous years. Of course, there is no one recipe for ad equity success. While the fourth-ranked player in ad equity, Google, follows a similar profile to Amazon, there are many other ways for a media brand to be a strong publisher partner. TikTok fell to number two in ad equity after being the leader in the previous two years; but compared to its competitors, TikTok ads are seen as the most fun and entertaining ads globally.

Sustainability and diversity

Amazon champions both diversity and inclusion in its workforce, products, communications, and suppliers. Kantar’s meta-analysis of growth drivers from Kantar BrandZ global data shows that brands with strong clarity (which means what they stand for is well understood) contribute 70% more to sales. However, the biggest success stories come from brands that are Meaningfully Different – those that stand out and then stand for something.

Amazon’s Sustainability efforts are helping the brand differentiate. Their efforts have been recognized by U.S. consumers, who ranked Amazon the topmost inclusive brand for diversity, equity, and inclusion, according to Kantar’s first-ever Brand Inclusion Index. Among the 2,860 respondents to Kantar’s survey, Amazon was noted for its inclusive advertising, for supporting under-represented business owners and communities, for offering products to people of diverse backgrounds, and for its long-term commitment to supporting these populations. Amazon was the #1 brand in both the US and the UK amongst people with disabilities.

Moreover, Amazon’s efforts have been consistently recognized with accolades and high scores by national benchmarking tools like the Disability Equality Index and the Human Rights Campaign’s Corporate Equality Index. Amazon recognizes its leverage and reach as a global business giant and works to share its platform with small and minority-owned businesses. It not only offers grants annually, but also provides resources year-round to help small businesses grow and flourish. The launch of the new AbilityOne storefront on Amazon Business made a significant boost in the federal procurement with a diversity mandate aimed at assisting manufacturers with a high proportion of disabled employees. Amazon’s storefront makes AbilityOne products more visible and easier to purchase.

Furthermore, Amazon invests in communities, whether through philanthropic endeavors like its AWS Imagine Grant Program, or STEM-focused programs like Amazon Future Engineer. Its commitment to empower and uplift communities drives brand affinity.

Three-fold benefits

For Amazon, there is a three-fold benefit to being Meaningful and Different and Salient. By showcasing its strength in the Meaningful category, it is not only meeting people’s needs, but connecting with consumers who feel emotionally connected to it. Difference contributes to perceptions that Amazon continues to be a trendsetter in retail, tech and business services and now healthcare, internet services and beyond. And Amazon’s power as Salient proves this brand comes to mind quickly in a purchase situation. Already dominating the retail space, Amazon has the capacity to capture significantly more attention than the typical super stores as the 2023 holiday season approaches. Consumers trust Amazon and are willing to follow the brand into a new category as it expands its portfolio. So, the question is, what industry will Amazon disrupt and dominate next?

Explore BrandZ data for free

Kantar recently launched a new, free interactive tool using BrandZ’s wealth of data where you can see an overarching view of a brand’s performance. Discover your top brand equity indicators—and those of your competitors—in seconds with Kantar BrandSnapshot powered by BrandZ.