Ad-supported streaming has made significant gains on ad-free alternatives, with a seismic year-on-year increase of 6 million viewers in the UK now willing to watch content with ads. As a result, ad-supported streaming reached a record 23 million subscriptions in Q3, narrowing the gap with ad-free options, which total 29 million viewers.

The Q3 2025 Entertainment on Demand (EoD) findings show that Amazon Prime Video reclaimed top spot from Disney+ in new paid subscriptions, DAZN’s strategy to host the FIFA Club World Cup during the quieter summer months paid off and Disney+ overtook Netflix in delivering the best overall ad experience.

Key behaviours within the Video-on-Demand (VoD) market in Q3 2025:

- Prime Video secured 17% of new paid sign-ups, narrowly ahead of Disney+ (16%)

- 40% of new subscriptions were ad-supported compared with 29% last year

- DAZN achieved record subscriber numbers, buoyed by interest in the FIFA Club World Cup among an overall quieter sporting calendar.

- Tubi continued to show sustained growth in the free ad-supported space, reaching over 10% of viewers in this category and impacting competitors such as Pluto TV, which is struggling to maintain viewers.

- The number of GB households with at least one paid video streaming service rose to 20.3 million in Q3 2025, an increase of 457,000 year-on-year.

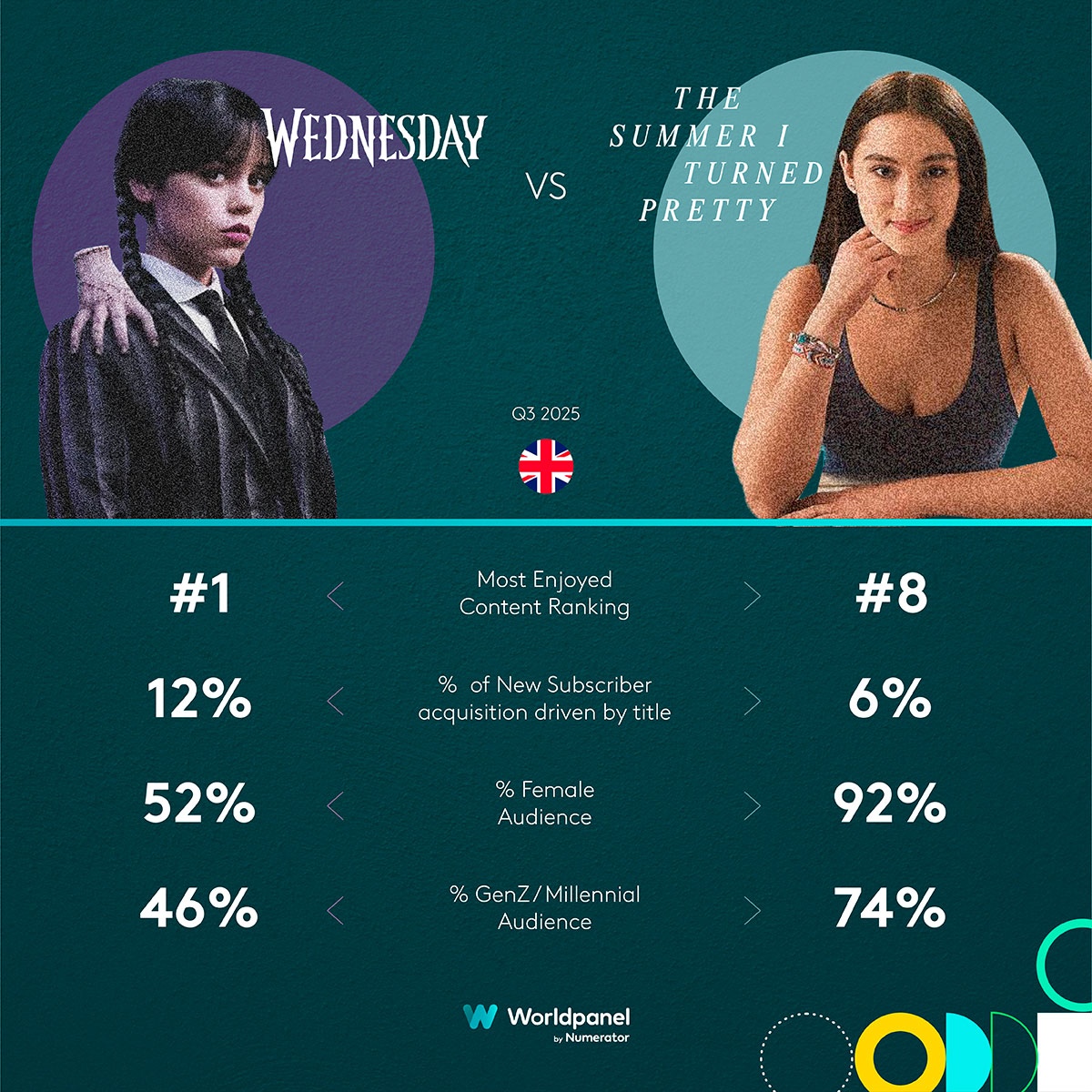

- Wednesday on Netflix was the most watched title, followed by Squid Game. Six of the top ten most watched titles were on Netflix, highlighting its strength in subscriber engagement.

Prime Video reclaims the top spot, as Netflix expands its portfolio of content

Prime Video’s return to the top spot in Q3 was fuelled by its slate of high-profile series such as Clarkson’s Farm, GenV and Reacher. Our data showed that one in five viewers joined the platform simply because they ‘love the brand’, a sentiment that is now on par with Disney+ and outpacing Netflix.

Echoing this momentum, Netflix turned in a solid Q3 performance that was defined by both depth and breadth. The second season of Wednesday dominated both ‘most watched’ and ‘most enjoyed’ lists, but the platform’s ability to secure six of the top ten most watched titles underlines the pulling power of its catalogue. This strength is proving instrumental in accelerating adoption of its ad-supported tier, with existing ad-free customers switching to lower cost plans alongside new sign-ups.

Disney+ overtook Netflix in subscriber satisfaction across all major ad metrics, including load, length, relevance and variation. Dissatisfaction with ads increases churn risk by 47%, making Disney’s improvement in these areas a strategic advantage as competition intensifies.

DAZN’s sports rights win delivers lasting impact

DAZN’s acquisition of FIFA Club World Cup rights in July sparked a near 50% surge in its UK customer base, its largest single month growth in the region. While the tournament was offered free via the DAZN app, nearly a third of new viewers converted to paid subscriptions. Crucially, DAZN maintained active user levels into August and September, suggesting its free access strategy may have successfully seeded long-term engagement.

The latest data underscores the growing shift in the streaming landscape, with ad-supported platforms increasingly closing the gap on ad-free alternatives. The rise in acceptance of ads among UK viewers, coupled with strong performances from platforms like Prime Video, Disney+, and DAZN, highlights a period of intense competition and strategic innovation. DAZN's ability to leverage sports content, Amazon Prime Video’s focus on brand loyalty, and Netflix's continued strength in content diversity demonstrate the evolving dynamics that are reshaping consumer preferences and subscription behaviours. As the market adapts, platforms that strike the right balance between content, cost, and customer experience will likely emerge as the key winners in this rapidly changing sector. Access the interactive data visualisation for more information.