Nationwide has successfully drawn upon its long history to drive brand growth, making significant strides in Kantar BrandZ’s UK Top 75 Most Valuable Brands Ranking. In the most recent year, Nationwide climbed seven positions to rank No.54, reaching a brand value of $1.31 billion with an impressive 34% increase from 2024. Nationwide was recently named the Kantar BrandZ UK Brand of the Year at Kantar Ignite event.

UK finance brands surge but Nationwide stands apart

Financial brands dominate the UK Top 75, accounting for over a quarter of the total brand value, with all finance brands experiencing double-digit growth compared to 2024. This sector-wide momentum surpasses the overall Top 75’s 8% growth, but Nationwide’s standout performance is notable: its roots reach back to 1884, and yet it has managed to outpace the industry. A key factor is that Nationwide is not a conventional bank.

A bank built for members, not shareholders

Nationwide operates as a building society, owned by its members rather than shareholders, similar to a credit union in the US. After over a century of mergers, it stands as the world’s largest building society and the UK’s second-largest provider of household savings and mortgages. Following the 2024 acquisition of Virgin Money, the Nationwide brand is poised for further growth, although both brands will remain distinct entities for the time being.

Nationwide tops Meaningful brand rankings in UK banking

Nationwide’s building society heritage fosters its reputation as the most Meaningful UK bank. Given that for decades the UK banking environment has been dominated by the "Big Four": Barclays UK, Lloyds Banking Group, NatWest, and HSBC UK, being the most Meaningful brand in the category is no mean feat. Kantar data reveals that Nationwide’s strong performance on Meaning is underpinned by its standout perceptions of making people’s lives better, genuinely caring for customers, and giving good advice, all of which reflect its primary mission to serve its members.

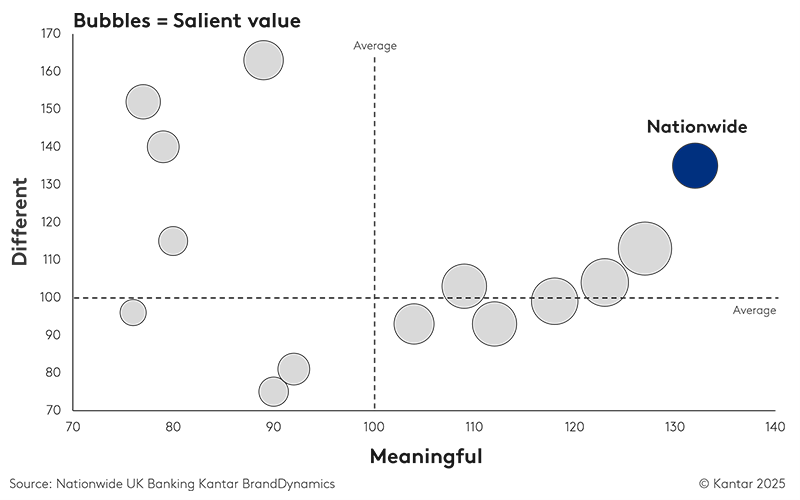

Kantar BrandDynamics data shows Nationwide outperforming category benchmarks across all key brand equity metrics: Meaningful, Different, and Salient. For marketers, it’s a compelling example of how emotional relevance and functional value can work together to build distinctive, enduring brand equity in a competitive landscape.

But the story doesn’t end there. While Meaning remains a core strength, the standout achievement is the significant uplift in Difference (now well above the category average), a critical driver of distinctiveness in a challenging market. This improvement signals Nationwide’s ability to break away from category norms and deliver a unique brand experience.

Nationwide’s current brand equity vs. category average

Holding ground as a Meaningful value brand amid fintech rivals

While Meaning is essential, strong brands also require Salience and Differentiation. Nationwide is on par with the Big Four in Salience, just slightly behind Barclays, reflecting its growing visibility in the category. However, when it comes to Difference, fintech challengers Monzo and Revolut, continue to lead the category, maintaining their edge through innovation and a distinct brand experience.

Nationwide’s brand equity in the competitive landscape

According to Kantar BrandSnapshot, Nationwide blends strong perceptions of Meaning with a high level of Differentiation, positioning it as a Value brand. In comparison, traditional banks are seen as Average, neither justifying a premium nor offering better value. In contrast, the digital-first brands have capitalised on the UK’s enthusiasm for mobile banking and are perceived as Great Value brands. Monzo, in particular, has successfully improved its brand equity over the years and, as its profile grows, it could pose a threat to the established banks, including Nationwide.

Responding to disruption with a bold rebrand

Aware of the growing threat, Nationwide launched a rebrand in 2023, the most significant in 36 years, aiming to present itself as a “dependable disrupter": a stable, trustworthy institution that also offers modern, innovative services designed to appeal to younger consumers. The refreshed visual identity and new slogan, “A good way to bank,” reinforce its mutual status and member-centric approach. The most recent instalment of the “A.N.Y. Bank” campaign, starring actor Dominic West as a spoof bank CEO, spotlights Nationwide’s 24/7 Scam Checker service, making a clear distinction between the brand and its competitors while underlining its commitment to serving customers.

If you’re unable to see the video above, please accept our website cookies or visit YouTube to watch the video.

Keeping the human touch in banking

Nationwide’s rebrand goes beyond a new look and new services, with a commitment to maintain its branch network, diverging from other high-street banks that have been closing branches. This strategy may appeal more to older and rural customers but could also attract those frustrated by digital banking disruptions and poor customer service dogged by digital sludge. Nationwide’s reputation for customer care could position it to offer superior omnichannel service, turning convenient, human-led assistance into a competitive edge, provided it can also deliver consistently on its core digital services.

The next chapter of growth for Nationwide

BrandSnapshot shows Nationwide is a dependable Mainstream brand, with the second-highest Future Power of all banks, highlighting its current strength and strong potential for future growth. Beyond the boost from acquiring Virgin Money, Nationwide’s ongoing organic success will depend on offering reliable care for existing members while innovating to engage younger consumers. The key challenge ahead lies in building stronger brand differentiation and leveraging its Value status to drive accelerated growth.

Read more about Nationwide’s success in Kantar BrandZ’s Most Valuable UK Brands report, available to download now.

BrandSnapshot is a free interactive tool powered by BrandZ’s wealth of data and validated Meaningful Different and Salient framework. Designed to give you a complete picture of brand equity in competitive context, BrandSnapshot delivers insights on over 15,000 brands in 40+ markets. Explore BrandSnapshot on Kantar Marketplace for free today.

Supercharged with proprietary AI technology, BrandDynamics uncovers trends and forecasts in real time to deliver true signals of your brand performance, so you can power your daily marketing decisions and shape your brand. Request a demo on Kantar Marketplace today.

Want more like this?

Read: Why Hermès’ quiet luxury speaks loudest

Read: ChatGPT is turning chat into brand power

Read: The ten cents on Tencent