There are not many brands who become both the generic name within their category and also the verb for their core business. Google takes on the Zooms and Xeroxes of the world with a name that rolls off the tongues of their 3.5 billion daily search users globally. And while last year, Apple and Amazon became the first brands in Kantar BrandZ history to surpass a half a trillion dollars in total brand value, Google joined them this year. The brand rose 79% year-on-year to become the world’s second most valuable brand in the Kantar BrandZ Most Valuable Global Brands 2022. They are the third fastest riser in brands within the Top 100 and tops by category this year.

What’s behind this year’s advancement? It is about search, but so much more.

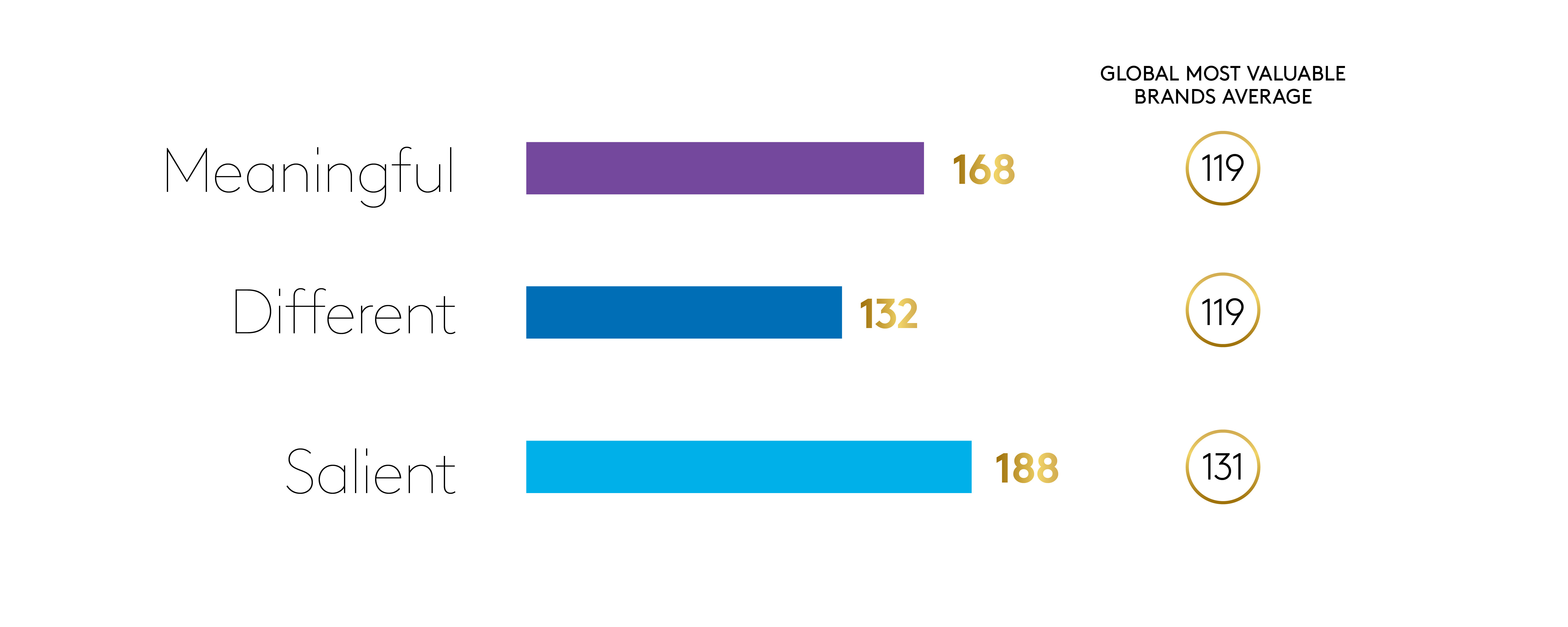

The trifecta of meaningful, different, and salient

Kantar evaluates brands on a matrix of being Meaningful, Different and Salient. The meaning of a brand can stem from a functional meaning, ie the brand does a good job of fulfilling a need consumers have. That could be a need for a reliable banking service, a safe and comfortable car, or a detergent that cleans your clothes. But to have longevity and lead a category, a brand must also have a layer of emotional meaning, and it’s this extra layer that creates lasting affinity between consumer and brand. Think of how Google is the lens through which so much of online activity flows and personal needs are met.

Difference is what leads a consumer to interrupt their normal buying habits – to stop, and look at a brand that catches their eye in a store, online or in the street. Alternatively, they pause to consider a brand that uses its communications to promise something special that others in its category do not. Given that purchase decisions are increasingly being made in seconds, or fractions of a second, that moment of being noticed can be crucial. Once again, Google Search, though it once faced a multiplicity of competitors, has dominated through its absolutely simple interface that just works so well.

The best brands also have Salience – a way of amplifying meaning and difference that acts as a catalyst for growth. Highly salient brands are the ones that spring to mind when a consumer thinks of a category or has a need, but people don’t just think of a famous name. They think of a name they believe will deliver meaning and difference. Once again, Google rises to the top here. How many people say that they are going to “search” for something online? They simply “Google” it.

Core business increases profitability

In 2022, Google’s advantage on search remains overwhelming, with the brand accounting for somewhere between 85% and 95% of the world’s search volume. In this core search business, Google has continued to find new ways to boost its average earnings per pageview. They have tweaked the product to increase advertising revenue from more “niche” or “long-tail” search keywords.

Google as a mega brand

This year, Kantar BrandZ refined its valuation process to better reflect certain megabrands’ cross-category reach. That meant, for instance, valuing Amazon Web Services as a separate Business Solutions and Technology Providers brand for the first time. Similar category adjustments were made to value Google Cloud Services (Business Solutions and Technology Providers) separately from Google (Media & Entertainment). Alphabet stablemates Google and YouTube also had a stellar showing, rising 79% and 83% in the Kantar BrandZ Most Valuable Global Brands 2022, respectively, in a year when the average brand in the Global Top 100 grew 23%.

Success in the post-cookie world

Google’s established dominance in search allowed it to navigate the transition to the “post-tracking” regulatory landscape from a position of strength. This year, Google’s Android platform will join Apple in introducing tools that encourage users to opt out of smartphone app tracking. They have an established relationship with billions of users and base much of their monetization not on IDs but on search terms. They also announced the “Sandbox”, their equivalent of a clean room, where advertisers can target using interest segments.

It is likely that in the absence of third-party trackers, the advantage will go to those brands and platforms with which consumers are most willing to share their own first-party data. That includes brands like Google. Think of how consumers very willingly share their location so that Google Maps shows them the way – and also recommends retail locations to fulfill ancillary needs.

Google and workspace increase penetration

The pandemic, with so many sudden remote workers and homeschoolers pushed Google Workplace, their suite of work and productivity apps (formerly known as GSpace) into households globally. They struck a blow to Microsoft and Apple, who had formerly dominated the school software market by offering both their free suite of tools and donating many Chromebooks. With so many having to switch to remote work, Workspace took leaps forward in usage and functionality. By the end of 2020, they had taken over two points of market share from Microsoft for office suite tools. It was a very smart move to integrate a Google Meet link into Google’s Calendar. No need to get a separate Zoom.

It’s in the Google Cloud

Google maintained its dominance in search while continuing to push into cloud services and consumer technology. Google’s parent company Alphabet exceeded $200 billion in revenue for the first time in 2021, and the BrandZ value of Google’s media and entertainment properties now stands at $766,779 million. Google Cloud’s fourth-quarter 2021 revenue rose 45 percent to $5.5 billion from the same period last year – with Google Cloud Platform (GCP) revenue outpacing that growth — as parent company Alphabet’s overall performance easily beat Wall Street expectations.

Great, moderately priced smartphones

Since the start of this decade, consumers began taking longer and longer to upgrade their old smartphones, all while the price of Apple and Samsung’s best-in-class handsets began to regularly top the imposing $1000 threshold. Google went the opposite pricing strategy of Apple and offered premium smartphones at half that price. While not quite as fast or powerful on a sheer computing level, Google phones focused on features that customers care most about: capabilities like 5G streaming and gaming, or the ability to take great pictures and video. Google Pixel’s AI image processing was released in 2021 to rave reviews from sources like CNET. Google’s new Pixel 6 smartphones are the first to feature Google’s in-house Tensor chip, a very smart move considering the global chip shortage. Tensor is optimized for Google’s strengths in image processing and artificial intelligence, offering faster and more accurate speech recognition and better battery life.

Google also pushed further into huge potential smartphone markets like India and partnered with homegrown telecom disruptor Jio to offer a budget smartphone priced at around $75.

Though just founded in 1998, Google has become one of the world’s most powerful and transformative brands whose products touch the majority of consumers’ daily lives. Number two is looking very good.