The total value of the world’s top food and beverage brands only fell by 3% year on year, as large brands remained resilient in the face of economic pressures that have affected other categories more deeply. In the context of a 20% overall decline for the top global brands, food and beverages’ slight dip represents the best performance this year of any category ranking.

Coca-Cola, the most valuable food and beverage brand valued at $98 billion, and was the only company in the BrandZ top 10 global brands who saw an increase in brand value year over year. Coca-Cola saw an increase of 9% from 2022, and an increase of about $18 billion since 2021.

Finding growth through strong marketing investment

Coca-Cola met the economic challenges of late 2022 by upping its final-quarter marketing spend, with plans to maintain that high investment throughout 2023. The brand’s ‘Real Magic’ marketing platform has aimed to leverage new insights around occasions and create new excitement around product innovations – but at core, it resonates because consumers really do need moments of escapism in challenging times. Last year, Coke and Diet Coke notched continued improvements to brand equity even in their core market of the US – which is no small feat for a brand that’s been around for almost 140 years.

Coca-Cola has succeeded in the 2020s, not only through continued brand investment during tough times but also by doubling down on innovation in a period when many brands pulled back. Coca-Cola Original Taste, for instance, has moved beyond mere ‘flavor twists’ (‘with lemon’, ‘with vanilla’, etc.) to embrace more creative, reimagining of its core flavor – including its recent ‘Move’ variant co-created with Spanish superstar Rosalía.

Using brand equity to support pricing margins

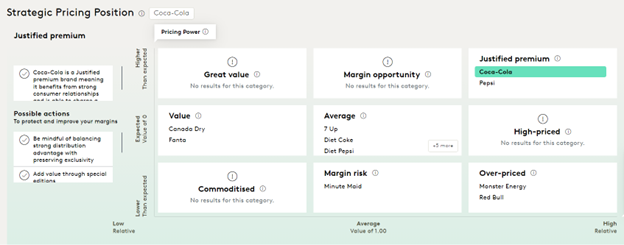

Coca-Cola finds itself as Justified Premium in the food and beverage space. Comparing perceived price with pricing power gives brands a strategic starting point. Consumers rate Coke as being valuable for their price, and we see that taste and taste perception is a big reason of this. 64% of Gen Z say, ‘the importance of treating myself is extremely or very important’, and Coca-Cola specifically benefits from this greatly.

Coca-Cola also drives premium perceptions through special product editions and association with special consumption occasions like Christmas and the Super Bowl. They have enhanced their customer relationships as well as simplify the purchasing process to make sure their consumer has the ideal experience when enjoying their can, bottle, or fountain drink.

DEI and Sustainability

Carbonated soft drinks brands have a head start when it comes to inclusion. The category is built on selling happiness and it wholeheartedly leans into universal values, such as togetherness and fun. Coca-Cola as a brand has shown the importance of consistent DEI efforts over many years. Coca Cola’s very first foray into inclusion marketing is an example: in 1971 it spent the equivalent of $1.6 million today to put 65 people from diverse backgrounds and cultures on a hilltop in Italy singing ‘I’d like to buy the world a Coke’.

Coke's Hilltop ad is still praised, 50 years after the fact. Inclusion is a long-term journey all brands need to embark on, and partnerships are also key. Coke has sponsored the Essence festival for 26 years and focuses on diverse celebrity sponsors including Zendaya, Lil Nas X and Black Panther. Coke has embedded inclusion across its business – in its products, services and communications but also within the brand's internal values, and growth strategy. Coke has earned its credibility in DEI because they’ve pioneered championing the under-represented and have been doing it for a long time. They’ve embedded themselves in culture – driving inclusion in areas such as sport and music.

Consumers recognize the brand has been diverse and inclusive for decades, and the product is massively accessible, affordable and global. Many consumers also mention the brand is non-controversial yet inclusive and inspiring.

Coca-Cola is also a leader for sustainability in the industry. BrandZ finds that sustainability is a small but important lever to drive volume share and a case for justifying a price premium. Their 2023 Water Security Strategy is an example for the industry, pledging to achieve 100% regenerative water use across 175 facilities; work with partners to improve the health of 60 most critical watersheds for the company's operations and supply chains; and aim to return a cumulative total of 2 trillion liters of water to nature and communities globally.

Explore BrandZ data for free

Kantar recently launched a new, free interactive tool using BrandZ’s wealth of data where you can see an overarching view of a brand’s performance. Discover your top brand equity indicators—and those of your competitors—in seconds with Kantar BrandSnapshot powered by BrandZ.